Agriculture (Schems)

Agriculture sector

Agriculture Schems

A. Krishonnati Yojana

It is an umbrella scheme which includes the following:

• National Food Security Mission (NFSM): to increase the production of rice, wheat and pulses. The mission is being continued during 12th plan with new target of additional production of 25 million tonnes of foodgrains comprising 10 million tonnes of rice, 8 million tonnes of wheat and 4 million tonnes of pulses and 3 million tonnes of coarse cereals.

• National Food Security Mission-Commercial Crops: for crop development programme on cotton, jute and sugarcane for enhancing productivity

• Mission for Integrated Development of Horticulture (MIDH): It covers wide horticulture base, which includes fruits, vegetables, tuber crops, mushrooms, spices and aromatic plants flowers and foliage and plantation crops like coconut, arecanut, cashew nut, cocoa and bamboo.

• National Mission on Oilseeds and Oil Palm: envisages increase in production of vegetable oils sourced from oilseeds, oil palm and tree borne oilseeds.

• National Mission for Sustainable Agriculture: aims at making agriculture more productive, sustainable and remunerative and climate resilient by promoting location specific integrated/composite farming systems; soil and moisture conservation measures; comprehensive soil health management; efficient water management practices and mainstreaming rainfed technologies.

• National Mission on Agricultural Extension and Technology: Its aim is to restructure and strengthen agricultural extension to enable delivery of appropriate technology and improved agronomic practices to the farmers consists.

It is an umbrella scheme which includes the following:

• National Food Security Mission (NFSM): to increase the production of rice, wheat and pulses. The mission is being continued during 12th plan with new target of additional production of 25 million tonnes of foodgrains comprising 10 million tonnes of rice, 8 million tonnes of wheat and 4 million tonnes of pulses and 3 million tonnes of coarse cereals.

• National Food Security Mission-Commercial Crops: for crop development programme on cotton, jute and sugarcane for enhancing productivity

• Mission for Integrated Development of Horticulture (MIDH): It covers wide horticulture base, which includes fruits, vegetables, tuber crops, mushrooms, spices and aromatic plants flowers and foliage and plantation crops like coconut, arecanut, cashew nut, cocoa and bamboo.

• National Mission on Oilseeds and Oil Palm: envisages increase in production of vegetable oils sourced from oilseeds, oil palm and tree borne oilseeds.

• National Mission for Sustainable Agriculture: aims at making agriculture more productive, sustainable and remunerative and climate resilient by promoting location specific integrated/composite farming systems; soil and moisture conservation measures; comprehensive soil health management; efficient water management practices and mainstreaming rainfed technologies.

• National Mission on Agricultural Extension and Technology: Its aim is to restructure and strengthen agricultural extension to enable delivery of appropriate technology and improved agronomic practices to the farmers consists.

B. Initiative for increasing flow of credit

• In order to ensure that all eligible farmers are provided with hassle free and timely credit for their agricultural operation, Kisan Credit Card (KCC) Scheme was introduced in 1998-99. The main objectives of the scheme are to meet the short term credit requirements for cultivation of crops, post harvest expenses, produce marketing loan, consumption requirements of farmer household, working capital for maintenance of farm assets and activities allied to agriculture like dairy animals, inland fishery, etc., investment credit requirement for agriculture and allied activities like pump sets, sprayers, dairy animals, etc.

• In order to ensure that all eligible farmers are provided with hassle free and timely credit for their agricultural operation, Kisan Credit Card (KCC) Scheme was introduced in 1998-99. The main objectives of the scheme are to meet the short term credit requirements for cultivation of crops, post harvest expenses, produce marketing loan, consumption requirements of farmer household, working capital for maintenance of farm assets and activities allied to agriculture like dairy animals, inland fishery, etc., investment credit requirement for agriculture and allied activities like pump sets, sprayers, dairy animals, etc.

C. Pradhan Mantri Fasal Bima Yojana

• Under the new scheme, the farmers’ premium has been kept at a maximum of 2 per cent for foodgrains and oilseeds, and up to 5 per cent for horticulture and cotton crops.

• There is no upper limit on Government subsidy. Even if balance premium is 90%, it will be borne by the Government. Earlier, there was a provision of capping the premium rate which resulted in low claims being paid to farmers. This capping was done to limit Government outgo on the premium subsidy. This capping has now been removed and farmers will get claim against full sum insured without any reduction.

• Importantly for the beneficiaries, crop losses which are covered under the scheme include Yield Losses as well as post-harvest losses, where coverage will be available up to a maximum period of 14 days from harvesting for those crops.

• The use of technology will be encouraged to a great extent resulting in operational efficiency. Smart phones will be used to capture and upload data of crop cutting to reduce the delays in claim payment to farmers. Remote sensing will be used to reduce the number of crop cutting experiments.

• Under the new scheme, the farmers’ premium has been kept at a maximum of 2 per cent for foodgrains and oilseeds, and up to 5 per cent for horticulture and cotton crops.

• There is no upper limit on Government subsidy. Even if balance premium is 90%, it will be borne by the Government. Earlier, there was a provision of capping the premium rate which resulted in low claims being paid to farmers. This capping was done to limit Government outgo on the premium subsidy. This capping has now been removed and farmers will get claim against full sum insured without any reduction.

• Importantly for the beneficiaries, crop losses which are covered under the scheme include Yield Losses as well as post-harvest losses, where coverage will be available up to a maximum period of 14 days from harvesting for those crops.

• The use of technology will be encouraged to a great extent resulting in operational efficiency. Smart phones will be used to capture and upload data of crop cutting to reduce the delays in claim payment to farmers. Remote sensing will be used to reduce the number of crop cutting experiments.

D. Mera Gaon, Mera Gaurav

• This scheme is being launched involving agricultural experts of agricultural universities and ICAR institutes for effective and deeper reach of scientific farming to the villages.

• A group of experts will be associated with one particular village to create awareness and adoption of new technologies including farm investment, loans, availability of inputs and marketing.

• All the scientists from ICAR and agricultural universities will participate in this initiative.

• This scheme is being launched involving agricultural experts of agricultural universities and ICAR institutes for effective and deeper reach of scientific farming to the villages.

• A group of experts will be associated with one particular village to create awareness and adoption of new technologies including farm investment, loans, availability of inputs and marketing.

• All the scientists from ICAR and agricultural universities will participate in this initiative.

E. Krishi Dak

• IARI initiated this novel scheme in 20 districts in which postmen supplied seeds of improved varieties of crops to the farmers in far-flung areas.

• Owing to its success and popularity, this scheme is being extended in 100 districts of 14 states with the association of Krishi Vigyan Kendras.

• This will provide improved seed to farmers at their doorstep.

• IARI initiated this novel scheme in 20 districts in which postmen supplied seeds of improved varieties of crops to the farmers in far-flung areas.

• Owing to its success and popularity, this scheme is being extended in 100 districts of 14 states with the association of Krishi Vigyan Kendras.

• This will provide improved seed to farmers at their doorstep.

F. Soil Health Card

• Soil Health cards are necessary to ensure that only requisite nutrients are applied in the soil in a balanced manner to enhance productivity of specific crops in a sustainable manner.

• Values on soil parameters such as pH, EC, N, P, K, S, Zn, Fe, Mn, Cu & B.

• Recommendation on appropriate dosage of fertilizer application based on test values and requirement of crop, use of organic manures and soil amendments to acidic/alkaline/sodic soils.

• Soil Health cards are necessary to ensure that only requisite nutrients are applied in the soil in a balanced manner to enhance productivity of specific crops in a sustainable manner.

• Values on soil parameters such as pH, EC, N, P, K, S, Zn, Fe, Mn, Cu & B.

• Recommendation on appropriate dosage of fertilizer application based on test values and requirement of crop, use of organic manures and soil amendments to acidic/alkaline/sodic soils.

G. Paramparagat Krishi Vikas Yojna (PKVY)

• Aim of the project is to maximize the utilization of natural resources through eco-friendly cultivation.

• Organic farming is a method of farming system which primarily aimed at cultivating the land and raising crops in such a way, as to keep the soil alive and in good health by use of organic wastes (crop, animal and farm wastes, aquatic wastes) and other biological materials along with beneficial microbes (bio-fertilizers) to release nutrients to crops for increased sustainable production in an eco friendly pollution free environment.

• Aim of the project is to maximize the utilization of natural resources through eco-friendly cultivation.

• Organic farming is a method of farming system which primarily aimed at cultivating the land and raising crops in such a way, as to keep the soil alive and in good health by use of organic wastes (crop, animal and farm wastes, aquatic wastes) and other biological materials along with beneficial microbes (bio-fertilizers) to release nutrients to crops for increased sustainable production in an eco friendly pollution free environment.

H. Promotion of National Market through Agri Tech Infrastructure Fund (ATIF)

• Central Sector Scheme for Promotion of National Agricultural Market through Agri-Tech Infrastructure Fund (ATIF) for Rs.200 crores to be implemented during 2014-15 to 2016-17.

• The Scheme envisages initiation of e-marketing platform at the national level and will support creation of infrastructure to enable e-marketing in 642 regulated markets across the country.

• For creation of a National Market, a common platform across all States is necessary. It is, therefore, proposed that a Service Provider be engaged centrally who would build, operate and maintain the e-platform on PPP (Build, Own, Operate, Transfer – BOOT) model. This platform would be customized/ configured to address the variations in different states.

• As an initiative of deregulation, States have been advised by the Government of India to bring fruits and vegetables out of the ambit of APMC Act. In pursuance of this advisory, 12 States have, so far, either de-regulated the marketing of fruits and vegetables or have exempted from levying of market fee.

• Central Sector Scheme for Promotion of National Agricultural Market through Agri-Tech Infrastructure Fund (ATIF) for Rs.200 crores to be implemented during 2014-15 to 2016-17.

• The Scheme envisages initiation of e-marketing platform at the national level and will support creation of infrastructure to enable e-marketing in 642 regulated markets across the country.

• For creation of a National Market, a common platform across all States is necessary. It is, therefore, proposed that a Service Provider be engaged centrally who would build, operate and maintain the e-platform on PPP (Build, Own, Operate, Transfer – BOOT) model. This platform would be customized/ configured to address the variations in different states.

• As an initiative of deregulation, States have been advised by the Government of India to bring fruits and vegetables out of the ambit of APMC Act. In pursuance of this advisory, 12 States have, so far, either de-regulated the marketing of fruits and vegetables or have exempted from levying of market fee.

I. MUDRA Bank

• The Finance Minister has proposed to create a Micro Units Development Refinance Agency (MUDRA) Bank, with a corpus of Rs. 20,000 crore, and credit guarantee corpus of 3,000 crore, which will refinance Micro-Finance Institutions through a Pradhan Mantri Mudra Yojana.

• Priority will be given to SC/ST enterprises in lending. MUDRA Bank will operate through regional level financing institutions who in turn will connect with last mile lenders such as MFIs, Small Banks, Primary Credit Cooperative Societies, Self Help Groups (SHGs), NBFC (other than MFI) and other lending institutions.

• MUDRA Bank will refinance Micro-Finance Institutions through a Pradhan Mantri Mudra Yojana (PMMY). In lending, priority will be given to SC/ST enterprises. These measures will greatly increase the confidence of young, educated or skilled workers who would not be able to aspire to become first generation entrepreneurs; existing small businesses, too will be able to expand their activities. Since the MUDRA Bank will be set up through an enactment of law and it will take some time.

• The Finance Minister has proposed to create a Micro Units Development Refinance Agency (MUDRA) Bank, with a corpus of Rs. 20,000 crore, and credit guarantee corpus of 3,000 crore, which will refinance Micro-Finance Institutions through a Pradhan Mantri Mudra Yojana.

• Priority will be given to SC/ST enterprises in lending. MUDRA Bank will operate through regional level financing institutions who in turn will connect with last mile lenders such as MFIs, Small Banks, Primary Credit Cooperative Societies, Self Help Groups (SHGs), NBFC (other than MFI) and other lending institutions.

• MUDRA Bank will refinance Micro-Finance Institutions through a Pradhan Mantri Mudra Yojana (PMMY). In lending, priority will be given to SC/ST enterprises. These measures will greatly increase the confidence of young, educated or skilled workers who would not be able to aspire to become first generation entrepreneurs; existing small businesses, too will be able to expand their activities. Since the MUDRA Bank will be set up through an enactment of law and it will take some time.

J. Krishi Kalyan Cess:

• Union Budget for 2016-17 (April-March) introduced a new cess on services named Krishi Kalyan Cess at the rate of 0.5%. The effective rate of the Krishi Kalyan Cess, however, will be lower than 0.5% as the government will provide input tax credit for the cess, as against no input tax credit for Swachh Bharat Cess.

• Proceeds of cess would be exclusively used for financing initiatives relating to improvement of agriculture and welfare of farmers.

• Union Budget for 2016-17 (April-March) introduced a new cess on services named Krishi Kalyan Cess at the rate of 0.5%. The effective rate of the Krishi Kalyan Cess, however, will be lower than 0.5% as the government will provide input tax credit for the cess, as against no input tax credit for Swachh Bharat Cess.

• Proceeds of cess would be exclusively used for financing initiatives relating to improvement of agriculture and welfare of farmers.

K. Direct Benefit Transfer (DBT) For Fertilizer Sector:

• Government also announced to introduce Direct Benefit Transfer of fertilizer subsidy to farmers on pilot basis in few districts of the country.

• The government has fixed the Maximum Retail Price (MRP) of Urea at Rs. 5,360 per tones.

• The government had allocated Rs.72, 968.56 crore for fertiliser subsidy, out of which Rs. 38,200 crore was earmarked for domestic Urea.

• Government also announced to introduce Direct Benefit Transfer of fertilizer subsidy to farmers on pilot basis in few districts of the country.

• The government has fixed the Maximum Retail Price (MRP) of Urea at Rs. 5,360 per tones.

• The government had allocated Rs.72, 968.56 crore for fertiliser subsidy, out of which Rs. 38,200 crore was earmarked for domestic Urea.

Union Territories Provisions and Issues

Union Territories Provisions

Union Territories Provisions and Issues

The Union Territories:

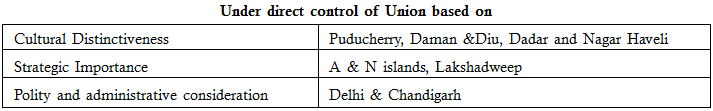

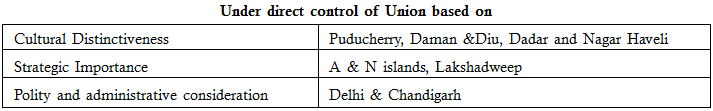

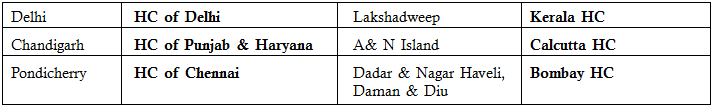

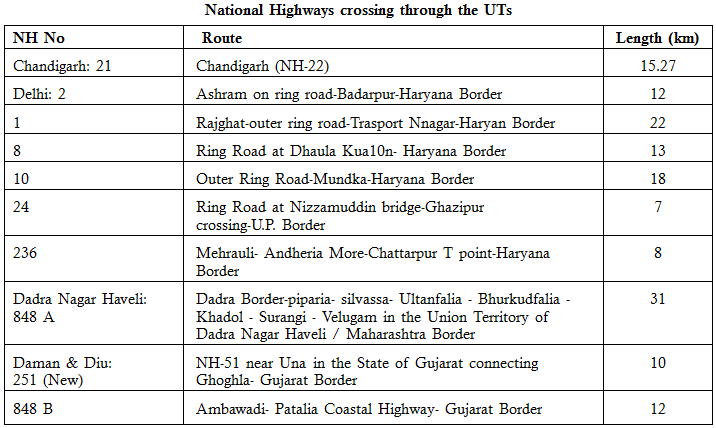

There are 7 Union territories viz. Chandigarh, Delhi, Andaman and Nicobar Islands, Lakshadweep, Dadra and Nagar Haveli, Daman and Diu and Pondicherry. Due to strategic, political and administrative considerations, the union territories have been placed under central administration.

• Union territories in India qualify as federal territories, by definition. But, do not take part in federal structure of the country.

• No uniform system of administration as parliament has the power to prescribe the structure of administration.

• A union territory is a type of administrative division in the Republic of India. Unlike the states, which have their own elected governments, union territories are ruled directly by the Union Government (Central Government), hence the name ‘union territory’.

• The Parliament of India can pass a law to amend the Constitution and provide a Legislature with elected Members and a Chief Minister for a Union Territory, as it has done for Delhi and Puducherry. In general, The President of India appoints an administrator or lieutenant-governor for each UT. There are seven union territories, including Delhi, the capital of India, and Chandigarh, the joint capital of Punjab and Haryana.

• Delhi and Puducherry (Pondicherry) operate somewhat differently from the other five. Delhi and Puducherry were given partial statehood and Delhi was redefined as the National Capital Territory of Delhi (NCT). Delhi and Puducherry have their own elected legislative assemblies and the executive councils of ministers with partially state-like function.

President may appoint Governor of a state as administrative of adjoining UT, who shall exercise his functions independent of his COMs.

Important Points to Remember:

• UT of Pondicherry & Delhi – Legislative assembly with Council of Ministers & Chief Minister.

• Size of CoMs is to be 10 % maximum of legislative assembly.

• Parliament can make laws on any subject given in 3 lists (Power also extends to Delhi & Pondicherry even though they have their own legislature).

• Pondicherry & Delhi can also make laws on any subject of state list & concurrent list except laws related to Public order, Police & land.

• President may frame regulations for peace, progress & good governance for all UTs except Delhi & Pondicherry

• Parliament is empowered to constitute a high court for any of the UT or even can declare an existing court there as high court.

There are 7 Union territories viz. Chandigarh, Delhi, Andaman and Nicobar Islands, Lakshadweep, Dadra and Nagar Haveli, Daman and Diu and Pondicherry. Due to strategic, political and administrative considerations, the union territories have been placed under central administration.

• Union territories in India qualify as federal territories, by definition. But, do not take part in federal structure of the country.

• No uniform system of administration as parliament has the power to prescribe the structure of administration.

• A union territory is a type of administrative division in the Republic of India. Unlike the states, which have their own elected governments, union territories are ruled directly by the Union Government (Central Government), hence the name ‘union territory’.

• The Parliament of India can pass a law to amend the Constitution and provide a Legislature with elected Members and a Chief Minister for a Union Territory, as it has done for Delhi and Puducherry. In general, The President of India appoints an administrator or lieutenant-governor for each UT. There are seven union territories, including Delhi, the capital of India, and Chandigarh, the joint capital of Punjab and Haryana.

• Delhi and Puducherry (Pondicherry) operate somewhat differently from the other five. Delhi and Puducherry were given partial statehood and Delhi was redefined as the National Capital Territory of Delhi (NCT). Delhi and Puducherry have their own elected legislative assemblies and the executive councils of ministers with partially state-like function.

President may appoint Governor of a state as administrative of adjoining UT, who shall exercise his functions independent of his COMs.

Important Points to Remember:

• UT of Pondicherry & Delhi – Legislative assembly with Council of Ministers & Chief Minister.

• Size of CoMs is to be 10 % maximum of legislative assembly.

• Parliament can make laws on any subject given in 3 lists (Power also extends to Delhi & Pondicherry even though they have their own legislature).

• Pondicherry & Delhi can also make laws on any subject of state list & concurrent list except laws related to Public order, Police & land.

• President may frame regulations for peace, progress & good governance for all UTs except Delhi & Pondicherry

• Parliament is empowered to constitute a high court for any of the UT or even can declare an existing court there as high court.

Advisory Committee:

Link between Parliament & UT, consulted by Government in regards to:

• General questions of policy relating to administration of subjects in state list.

• All legislative proposals in state list pertaining to the territories.

• Matters relating to annual financial statement of territories.

Link between Parliament & UT, consulted by Government in regards to:

• General questions of policy relating to administration of subjects in state list.

• All legislative proposals in state list pertaining to the territories.

• Matters relating to annual financial statement of territories.

Administration of Union Territories (Art. 239):

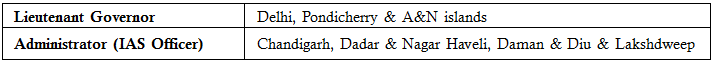

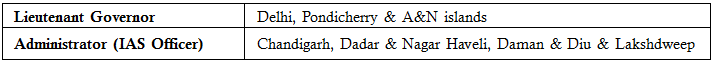

A Union Territory is administered by the President acting through an administrator to be appointed by him with such designation as he may specify. There is no uniformity in the designation of the administrator. It is at some places Lieutenant Governor (e.g., Delhi and Puducherry) at other Chief Commissioner or Administrator. The Governor of state may be appointed as Administrator of an adjoining Union Territory. An Administrator of Union Territories is not a head of state like a Governor but is an agent of the President.

A Union Territory is administered by the President acting through an administrator to be appointed by him with such designation as he may specify. There is no uniformity in the designation of the administrator. It is at some places Lieutenant Governor (e.g., Delhi and Puducherry) at other Chief Commissioner or Administrator. The Governor of state may be appointed as Administrator of an adjoining Union Territory. An Administrator of Union Territories is not a head of state like a Governor but is an agent of the President.

Legislature and Council of Ministers in Union Territories (Art. 239A):

In 1962 Art. 239A was inserted in the constitution empowering Parliament to create legislature or a Council of Ministers or both for some of the Union Territories. In exercise of this power the Parliament passed the government of Union Territories Act, 1963, which created a legislature as well as a Council of Ministers for some of the Union Territories. As some of the territories have become states now, only Delhi and Puducherry are now left in this class. Creation of legislative Assembly or a Council of Ministers by enacting a law is not treated as an amendment of the constitution for the purpose of Art. 368.

In 1962 Art. 239A was inserted in the constitution empowering Parliament to create legislature or a Council of Ministers or both for some of the Union Territories. In exercise of this power the Parliament passed the government of Union Territories Act, 1963, which created a legislature as well as a Council of Ministers for some of the Union Territories. As some of the territories have become states now, only Delhi and Puducherry are now left in this class. Creation of legislative Assembly or a Council of Ministers by enacting a law is not treated as an amendment of the constitution for the purpose of Art. 368.

Special provisions for Delhi:

• The 69th Amendment Act, 1992 has added two new Art. 239AA and Art. 239AB under which the Union Territory of Delhi has been given a special status.

• Art. 239AA provides that the Union Territory of Delhi shall now be called the National Capital Territory of Delhi and its administrator shall be known as Lt. Governor.

• It also creates a legislative assembly for Delhi which can make laws on the state list and concurrent list except on these matters: public order, land and police.

• It also provides for a Council of Ministers for Delhi consisting of not more than 10% of the total number of members in the assembly.

• The President shall make appointments to the Council of Ministers including the Chief Minister.

• The 69th Amendment Act, 1992 has added two new Art. 239AA and Art. 239AB under which the Union Territory of Delhi has been given a special status.

• Art. 239AA provides that the Union Territory of Delhi shall now be called the National Capital Territory of Delhi and its administrator shall be known as Lt. Governor.

• It also creates a legislative assembly for Delhi which can make laws on the state list and concurrent list except on these matters: public order, land and police.

• It also provides for a Council of Ministers for Delhi consisting of not more than 10% of the total number of members in the assembly.

• The President shall make appointments to the Council of Ministers including the Chief Minister.

Position of President and Administer:

Union Territories are centrally administered under Art. 29. They do not get merged with the central government and form part of no state. They do not loose their existence as a separate entity though the not central government controls them. The administrator functions as delegate of the President and will have to Act under the orders of the President that is the central government.

Union Territories are centrally administered under Art. 29. They do not get merged with the central government and form part of no state. They do not loose their existence as a separate entity though the not central government controls them. The administrator functions as delegate of the President and will have to Act under the orders of the President that is the central government.

Constitutional break down (Art.239 AA):

If a situation arises in which the administration of the national capital territory cannot be carried on in accordance with Art. 239AA or the Act of 1991 etc. the President may on receipt of a report from the Lieutenant Governor or otherwise suspend the operation of the above laws and make such incidental or consequential provisions as may appear to him necessary. (Art. 239AB).

The President may take action on the report of the Lieutenant Governor or otherwise. This provision resembles Art. 356.

If a situation arises in which the administration of the national capital territory cannot be carried on in accordance with Art. 239AA or the Act of 1991 etc. the President may on receipt of a report from the Lieutenant Governor or otherwise suspend the operation of the above laws and make such incidental or consequential provisions as may appear to him necessary. (Art. 239AB).

The President may take action on the report of the Lieutenant Governor or otherwise. This provision resembles Art. 356.

Ordinance making power (Art. 239B):

Article 239 B gives the administrator power to promulgate an ordinance when the legislative assembly of a Union Territory is not in session. An ordinance may be promulgated only after obtaining instructions from the President.

Article 239 B gives the administrator power to promulgate an ordinance when the legislative assembly of a Union Territory is not in session. An ordinance may be promulgated only after obtaining instructions from the President.

Power of the President to make regulations (Art. 240):

The President has the power to make regulations for the peace, order and good government of the Union Territory of:

(a) Andaman and Nicobar islands

(b) Lakshadweep

(c) Dadra and Nagara Haveli

(d) Daman and Diu.

Since, these territories do not have a legislature; the legislative function is assigned to the President.

In the case of Puducherry also, the president can legislate by making regulations but only when the assembly is suspended or dissolved.

The President has the power to make regulations for the peace, order and good government of the Union Territory of:

(a) Andaman and Nicobar islands

(b) Lakshadweep

(c) Dadra and Nagara Haveli

(d) Daman and Diu.

Since, these territories do not have a legislature; the legislative function is assigned to the President.

In the case of Puducherry also, the president can legislate by making regulations but only when the assembly is suspended or dissolved.

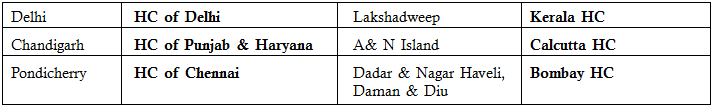

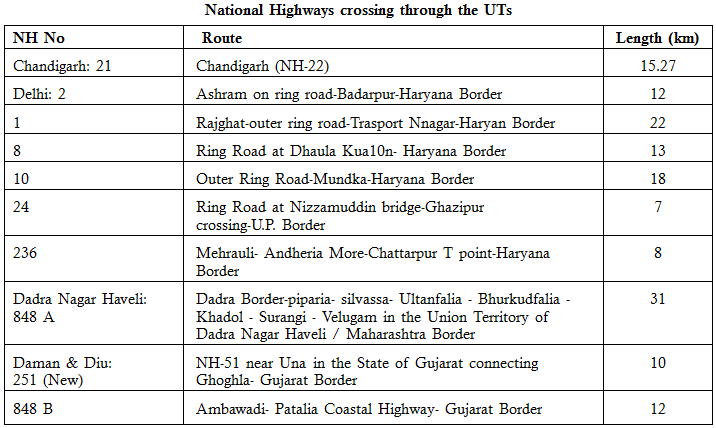

High Court for Union Territory (Art. 241):

• Parliament may by-law constitute a High Court for a Union Territory or declare the High Court of a state having jurisdiction over a Union Territory.

• The Punjab and Haryana High Court has jurisdiction over Chandigarh.

• The Kerala High Court caters to Lakshadweep. The Andaman and Nicobar Islands are under the Calcutta High Court.

• Puducherry falls under Madras High Court.

• The Bombay High Court is the High Court for Dadar and Nagar Haveli as also for Daman and Diu. Delhi is the only Union Territory having its own High Court Since 1966.

69th AMENDMENT 1991:

• UT of Delhi shall be called National capital territory & shall have a legislative assembly with members, chosen directly by people from territorial constituencies. (Special Provisions related to the Delhi- Art. 239AA).

• The administrator thereof appointed under article 239 shall be designated as the Lieutenant Governor.

• Assembly shall make laws on matter enumerated in state list (Except matters of Public order, Police & land).

• If any provision of law, made by legislative assembly with respect to any matter which is repugnant to any provision of law made by parliament related to that matter, then law made by parliament shall prevail & law made by LA shall to the extent of repugnancy, be void.

• If law made by LA is preserved for consideration of President & has received his assent, then such law shall prevail in NCT, however, parliament can make laws adding to, varying or repealing laws made by LA.

• There shall be COMs, not more than 1/10th of total members of Legislative Assembly, with CM at its apex to aid & advice Lt. governor in exercise of his functions.

• In case of difference between opinions of COMs & Lt. governor, Lt. governor shall refer it to the President for his decision & shall act according to directions given by President.

– Union territories of India have special rights and status due to their constitutional formation and development.

– The status of ‘Union Territory’ may be assigned to an Indian sub-jurisdiction for reasons such as safeguarding the rights of indigenous cultures, averting political turmoil related to matters of governance, and so on.

– These union territories could be changed to states in the future for more efficient administrative control.

• Parliament may by-law constitute a High Court for a Union Territory or declare the High Court of a state having jurisdiction over a Union Territory.

• The Punjab and Haryana High Court has jurisdiction over Chandigarh.

• The Kerala High Court caters to Lakshadweep. The Andaman and Nicobar Islands are under the Calcutta High Court.

• Puducherry falls under Madras High Court.

• The Bombay High Court is the High Court for Dadar and Nagar Haveli as also for Daman and Diu. Delhi is the only Union Territory having its own High Court Since 1966.

69th AMENDMENT 1991:

• UT of Delhi shall be called National capital territory & shall have a legislative assembly with members, chosen directly by people from territorial constituencies. (Special Provisions related to the Delhi- Art. 239AA).

• The administrator thereof appointed under article 239 shall be designated as the Lieutenant Governor.

• Assembly shall make laws on matter enumerated in state list (Except matters of Public order, Police & land).

• If any provision of law, made by legislative assembly with respect to any matter which is repugnant to any provision of law made by parliament related to that matter, then law made by parliament shall prevail & law made by LA shall to the extent of repugnancy, be void.

• If law made by LA is preserved for consideration of President & has received his assent, then such law shall prevail in NCT, however, parliament can make laws adding to, varying or repealing laws made by LA.

• There shall be COMs, not more than 1/10th of total members of Legislative Assembly, with CM at its apex to aid & advice Lt. governor in exercise of his functions.

• In case of difference between opinions of COMs & Lt. governor, Lt. governor shall refer it to the President for his decision & shall act according to directions given by President.

– Union territories of India have special rights and status due to their constitutional formation and development.

– The status of ‘Union Territory’ may be assigned to an Indian sub-jurisdiction for reasons such as safeguarding the rights of indigenous cultures, averting political turmoil related to matters of governance, and so on.

– These union territories could be changed to states in the future for more efficient administrative control.

Leader of Opposition (LoP)

Leader of Opposition (LoP)

• In the year 1977- The leaders of opposition in Lok Sabha and Rajya Sabha were given statutory recognition.

• They provide constructive criticism of the government policies.

• Gets same salaries and allowances that are equivalent to a Cabinet minister – paid by the government.

• To become leader of opposition, the single largest political party in opposition should have atleast 10% seats in the Lok Sabha. The Leader of such a party acts as the Leader of Opposition.

Eligibility criteria of the LoP:

• Each house has a LoP – leader of the largest party that has not less than one-tenth of the total strength of the house. In Lok sabha, total strength = 545, one tenth = 55.

• Largest party in opposition and its leader is recognized by the Speaker / Chairman as a matter of convention established by 1st lok sabha speaker GV Mavlankar. Main opposition’s strength must be 10% of the total strength. The convention was later incorporated in Direction 121c, Directions by the Speaker.

• LoP accorded statutory status and defined under Salary and allowances of Leaders of Opposition in Parliament Act, 1977.

• They provide constructive criticism of the government policies.

• Gets same salaries and allowances that are equivalent to a Cabinet minister – paid by the government.

• To become leader of opposition, the single largest political party in opposition should have atleast 10% seats in the Lok Sabha. The Leader of such a party acts as the Leader of Opposition.

Eligibility criteria of the LoP:

• Each house has a LoP – leader of the largest party that has not less than one-tenth of the total strength of the house. In Lok sabha, total strength = 545, one tenth = 55.

• Largest party in opposition and its leader is recognized by the Speaker / Chairman as a matter of convention established by 1st lok sabha speaker GV Mavlankar. Main opposition’s strength must be 10% of the total strength. The convention was later incorporated in Direction 121c, Directions by the Speaker.

• LoP accorded statutory status and defined under Salary and allowances of Leaders of Opposition in Parliament Act, 1977.

Significance of the LoP:

• To provide constructive criticism on the policies of the government.

• Helps to represent a view contrary from that of government.

• LoP is required on the panels that recommend key appointments like Lokpal, CVC, CIC etc.

• As per the 2nd ARC setup a Civil service Board- for transfer posting of top bureaucratic posts, the members of this Committee, will be selected by PM and LoP.

• To provide constructive criticism on the policies of the government.

• Helps to represent a view contrary from that of government.

• LoP is required on the panels that recommend key appointments like Lokpal, CVC, CIC etc.

• As per the 2nd ARC setup a Civil service Board- for transfer posting of top bureaucratic posts, the members of this Committee, will be selected by PM and LoP.

Different committees and Role of the LoP:

Current Controversy related to the post (10% Rule):

• Congress being the second largest party has 44 seats. Even If; in count the whole UPA alliance- its 60 members. It falls short of the 10% norm. After 10 years of being in the power, it does not get even LoP.

• Therefore, Speaker of the LS declares, ‘neither congress nor the UPA leader can be declared as the leader of opposition in Lok Sabha because none has won the required 55 seats.”

• Congress has been demanding the post of LoP but the Speaker rejected their proposal citing conventions and norms. However, her decision was criticized as there is no law that mandates the 10% eligibility.

(In 16th Lok Sabha Assembly, National congress party did not get the requisite number and made the leader of opposition ( LoP ) in spite of not having LoP recognition , Mallikarjun Kharge has been inducted in CIC selection panel.)

Comparison with other Countries:

• Britain- the opposition is formally designated Her Majesty’s Loyal Opposition. They also form the Shadow Cabinet to balance the ruling cabinet and prepare its members for future ministerial offices.

• United States – The President is held accountable by minority parties in Congress.

A flourishing democracy should accommodate the fundamental right to dissent. Inclusion of LoP provides objectivity and a contrarian perspective to decisions and appointments made by the government.

• Britain- the opposition is formally designated Her Majesty’s Loyal Opposition. They also form the Shadow Cabinet to balance the ruling cabinet and prepare its members for future ministerial offices.

• United States – The President is held accountable by minority parties in Congress.

A flourishing democracy should accommodate the fundamental right to dissent. Inclusion of LoP provides objectivity and a contrarian perspective to decisions and appointments made by the government.

The Aadhaar Act, 2016

The Aadhaar Act, 2016

The Directive Principles of State Policy (DPSPs) of Indian Constitution mandates government to provide various kinds of welfare measures to the people. These initiatives like old age pension, scholarships, food supply at cheap prices suffered from issues of leakages in absence of proper universal identification tool. Aadhaar initiative uses the advancements in technical fields to sort out the legacy issues of exclusion, corruption and provide many other ancillary benefits. The Aadhaar Act gives statutory backing to whole process.

The Act intends to provide for targeted delivery of subsidies and services to individuals residing in India by assigning them unique identity numbers, called Aadhaar numbers.

The Act intends to provide for targeted delivery of subsidies and services to individuals residing in India by assigning them unique identity numbers, called Aadhaar numbers.

Salient features:

• Every resident shall be entitled to obtain an Aadhaar number. A resident is a person who has resided in India for 182 days, in the one year preceding the date of application for enrolment for Aadhaar.

• Every resident shall be entitled to obtain an Aadhaar number. A resident is a person who has resided in India for 182 days, in the one year preceding the date of application for enrolment for Aadhaar.

• To obtain an Aadhaar number, an individual has to submit his, (i) biometric (photograph, finger print, iris scan) and (ii) demographic (name, date of birth, address) information.

• The key functions of the UID authority include, (i) specifying demographic and biometric information to be collected during enrolment, (ii) assigning Aadhaar numbers to individuals, (iii) authenticating Aadhaar numbers, and (iv) specifying the usage of Aadhaar numbers for delivery of subsidies and services.

• The UID authority will consist of a chairperson, two part-time members and a chief executive officer. The chairperson and members are required to have experience of at least ten years in matters such as technology, governance, etc.

• iometric information such as an individual’s finger print, iris scan and other biological attributes (specified by regulations) will be used only for Aadhaar enrolment and authentication, and for no other purpose.

• In two cases, information may be revealed:

a) In the interest of national security, a Joint Secretary in the central government may issue a direction for revealing, (i) Aadhaar number, (ii) biometric information (iris scan, finger print and other biological attributes specified by regulations), (iii) demographic information, and (iv) photograph. Such a decision will be reviewed by an Oversight Committee (comprising Cabinet Secretary, Secretaries of Legal Affairs and Electronics and Information Technology) and will be valid for six months.

b) On the order of a court, (i) an individual’s Aadhaar number, (ii) photograph, and (iii) demographic information, may be revealed.

• A person may be punished with imprisonment upto three years and minimum fine of Rs 10 lakh for unauthorised access to the centralized data-base, including revealing any information stored in it.

• No court shall take cognizance of any offence except on a complaint made by the UID authority or a person authorised by it.

• A person may be punished with imprisonment upto three years and minimum fine of Rs 10 lakh for unauthorised access to the centralized data-base, including revealing any information stored in it.

• No court shall take cognizance of any offence except on a complaint made by the UID authority or a person authorised by it.

Enemy Property Act

Enemy Property Act

In the wake of the India-Pakistan wars of 1965 and 1971, there was migration of people from India to Pakistan. Under the Defense of India Rules framed under the Defense of India Act, the Government of India took over the properties and companies of those who took Pakistani nationality.

These “Enemy Properties” were vested by the central government in the Custodian of Enemy Property for India.

The Enemy Property Act was enacted in the year 1968 by the Government of India, which provided for the continuous vesting of enemy property in the Custodian of Enemy Property for India. The Central Government, through the Custodian, is in possession of enemy properties spread across many states in the country.

The bill has been proposed to amend it.

The Bill amends the Enemy Property Act, 1968, to vest all rights, titles and interests over enemy property in the Custodian

The Bill declares transfer of enemy property by the enemy, conducted under the Act, to be void. This applies retrospectively to transfers that have occurred before or after 1968.

The Bill prohibits civil courts and other authorities from entertaining disputes related to enemy property.

The Bill prohibits civil courts from entertaining any disputes with regard to enemy property. It does not provide any alternative judicial remedy in terms of tribunals.

The properties vested in the custodian of enemy property for India includes both moveable and immovable properties. The immovable properties are valued at more than Rs 1 lakh crore, while the movable property is valued at more than Rs 3,000 crore.

These “Enemy Properties” were vested by the central government in the Custodian of Enemy Property for India.

The Enemy Property Act was enacted in the year 1968 by the Government of India, which provided for the continuous vesting of enemy property in the Custodian of Enemy Property for India. The Central Government, through the Custodian, is in possession of enemy properties spread across many states in the country.

The bill has been proposed to amend it.

The Bill amends the Enemy Property Act, 1968, to vest all rights, titles and interests over enemy property in the Custodian

The Bill declares transfer of enemy property by the enemy, conducted under the Act, to be void. This applies retrospectively to transfers that have occurred before or after 1968.

The Bill prohibits civil courts and other authorities from entertaining disputes related to enemy property.

The Bill prohibits civil courts from entertaining any disputes with regard to enemy property. It does not provide any alternative judicial remedy in terms of tribunals.

The properties vested in the custodian of enemy property for India includes both moveable and immovable properties. The immovable properties are valued at more than Rs 1 lakh crore, while the movable property is valued at more than Rs 3,000 crore.

No comments:

Post a Comment