National Income Concept/Calculation of National Income

Calculation of National Income Other Concepts Associated with National Income

National Income Concept

• National Income is the total value of all final goods and services produced by the country in certain year. The growth of National Income helps to know the progress of the country.

• In other words, the total amount of income accruing to a country from economic activities in a year’s time is known as national income. It includes payments made to all resources in the form of wages, interest, rent and profits.

• From the modern point of view, national income is defined as “the net output of commodities and services flowing during the year from the country’s productive system in the hands of the ultimate consumers.”

National Income Accounting (NIA)

National Income Accounting is a method or technique used to measure the economic activity in the national economy as a whole.

• In other words, the total amount of income accruing to a country from economic activities in a year’s time is known as national income. It includes payments made to all resources in the form of wages, interest, rent and profits.

• From the modern point of view, national income is defined as “the net output of commodities and services flowing during the year from the country’s productive system in the hands of the ultimate consumers.”

National Income Accounting (NIA)

National Income Accounting is a method or technique used to measure the economic activity in the national economy as a whole.

NIA is mainly done for:

• Policy Formulation: It helps in comparing the estimates of the past from the future and also forecast the growth rates in future. For example, if a country has a GDP of Rs. 103 Lakh which is 3 Lakh rupees higher than the last year, it has a growth rate of 3 per cent.

• Policy Formulation: It helps in comparing the estimates of the past from the future and also forecast the growth rates in future. For example, if a country has a GDP of Rs. 103 Lakh which is 3 Lakh rupees higher than the last year, it has a growth rate of 3 per cent.

• Effective Decision Making: To estimate the contribution of each of the sectors of the economy. It helps the business to plan for production.

• International Economic Comparison: It helps in comparing the level of development of countries and provides useful insight into how well an economy is functioning, and where money is being generated and spent. One can compare the standard of living of different nations and its growth rate.

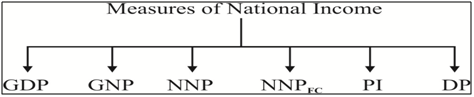

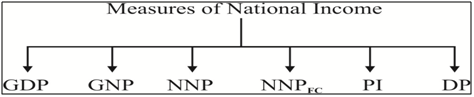

There are various terms associated with measuring of National Income.

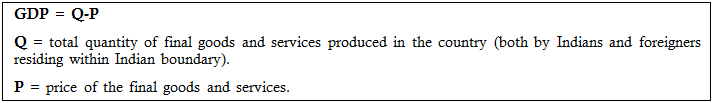

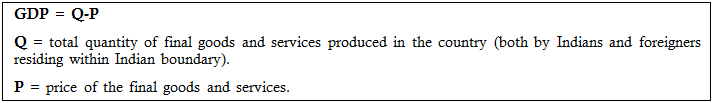

A. GDP (GROSS DOMESTIC PRODUCT)

A. GDP (GROSS DOMESTIC PRODUCT)

• Here the catch word is ‘Domestic’ which refers to ‘Geographical Area’

• The total value of all final goods and services produced within the boundary of the country during a given period of time (generally one year) is called as GDP.

• In this case, the final produce of resident citizens as well as foreign nationals who reside within that geographical boundary is considered.

There are various terms associated with measuring of National Income.

A. GDP (GROSS DOMESTIC PRODUCT)

A. GDP (GROSS DOMESTIC PRODUCT)• Here the catch word is ‘Domestic’ which refers to ‘Geographical Area’

• The total value of all final goods and services produced within the boundary of the country during a given period of time (generally one year) is called as GDP.

• In this case, the final produce of resident citizens as well as foreign nationals who reside within that geographical boundary is considered.

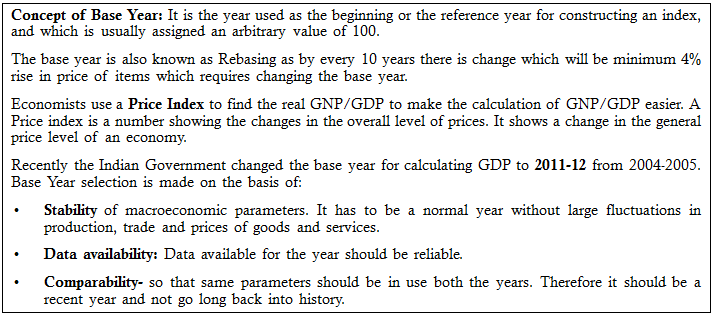

Types of GDP: Real GDP and Nominal GDP

• Real GDP: Refers to the current year production of goods and services valued at base year prices. Such base year prices are Constant Prices.

• Real GDP: Refers to the current year production of goods and services valued at base year prices. Such base year prices are Constant Prices.

• Nominal GDP: Refers to current year production of final goods and services valued at current year prices.

Which one is a better measure?

• Real GDP is a better measure to calculate the GDP because in a particular year GDP may be inflated because of high rate of inflation in the economy.

• Real GDP therefore allows us to determine if production increased or decreased, regardless of changes in the inflation and purchasing power of the currency.

• Real GDP is a better measure to calculate the GDP because in a particular year GDP may be inflated because of high rate of inflation in the economy.

• Real GDP therefore allows us to determine if production increased or decreased, regardless of changes in the inflation and purchasing power of the currency.

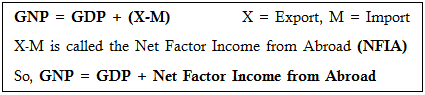

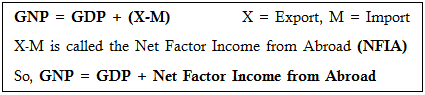

B. GROSS NATIONAL PRODUCT (GNP)

• Here the catch word is ‘National’ which refers to all the citizens of a country.

• GNP is the total value of the total production or final goods and services produced by the nationals of a country during a given period of time (generally one year).

• In this case, the income of all the resident and non-resident citizens (who resides in abroad) of a country in included whereas, the income of foreigners who reside within India is excluded.

• The GNP contains the income earned by Indian Nationals (both in Indian Territory and Abroad) only.

• Here the catch word is ‘National’ which refers to all the citizens of a country.

• GNP is the total value of the total production or final goods and services produced by the nationals of a country during a given period of time (generally one year).

• In this case, the income of all the resident and non-resident citizens (who resides in abroad) of a country in included whereas, the income of foreigners who reside within India is excluded.

• The GNP contains the income earned by Indian Nationals (both in Indian Territory and Abroad) only.

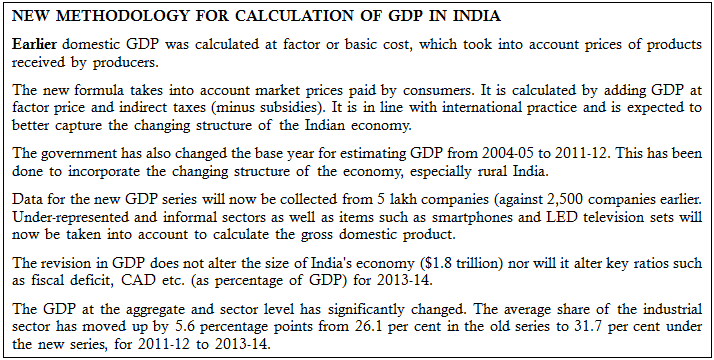

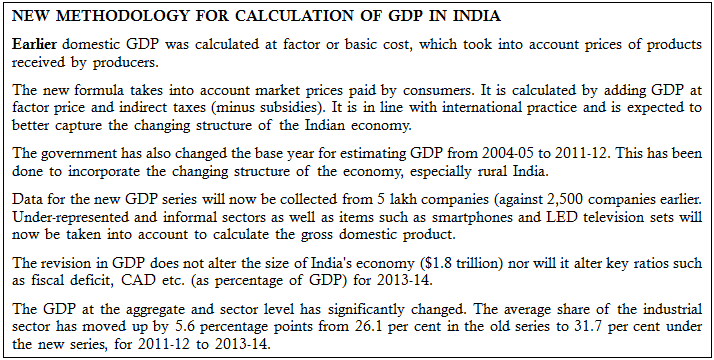

GDP and GNP are measured on the basis of Market Price and Factor Cost.

a) Market Price

It refers to the actual transacted price which includes indirect taxes such as custom duty, excise duty, sales tax, service tax etc. (impending Goods and Services Tax). These taxes tend to raise the prices of the goods in an economy.

a) Market Price

It refers to the actual transacted price which includes indirect taxes such as custom duty, excise duty, sales tax, service tax etc. (impending Goods and Services Tax). These taxes tend to raise the prices of the goods in an economy.

b) Factor Cost

It is the cost of factors of production i.e. rent for land interest for capital, wages for labour and profit for entrepreneurship. This is equal to revenue price of the final goods and services sold by the producers.

Revenue Price (or Factor Cost) = Market Price – Net Indirect Taxes

Net Indirect Taxes = Indirect Taxes – Subsidies

Hence, Factor Cost = Market Price – Indirect Taxes + Subsidies

It is the cost of factors of production i.e. rent for land interest for capital, wages for labour and profit for entrepreneurship. This is equal to revenue price of the final goods and services sold by the producers.

Revenue Price (or Factor Cost) = Market Price – Net Indirect Taxes

Net Indirect Taxes = Indirect Taxes – Subsidies

Hence, Factor Cost = Market Price – Indirect Taxes + Subsidies

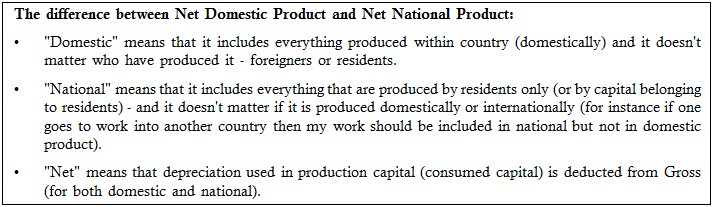

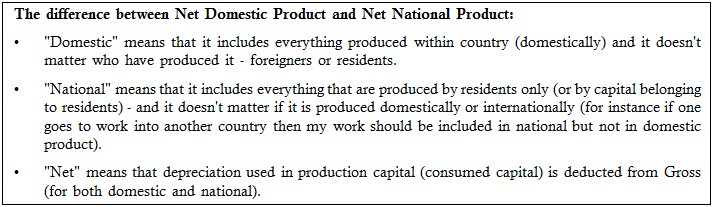

C. Net National Product (NNP): NNP = GNP – Depreciation

• It is calculated by subtracting Depreciation from Gross National Product.

• Depreciation – Wear and Tear of goods produced.

• This deduction is done because a part of current produce goes to replace the depreciated parts of the products already produced. This part does not add value to current year’s total produce. It is used to keep the products already produced intact and hence it is deducted.

• It is calculated by subtracting Depreciation from Gross National Product.

• Depreciation – Wear and Tear of goods produced.

• This deduction is done because a part of current produce goes to replace the depreciated parts of the products already produced. This part does not add value to current year’s total produce. It is used to keep the products already produced intact and hence it is deducted.

D. Net Domestic Product (NDP): NDP = GDP – Depreciation

• It is the calculated GDP after adjusting the value of depreciation. This is basically, Net form of GDP, i.e. GDP – total value of wear and tear.

• NDP of an economy is always lower than its GDP, since their depreciation can never be reduced to zero. The concept of NDP and NNP are not used to compare different economies because the method of calculating depreciation varies from country to country.

• It is the calculated GDP after adjusting the value of depreciation. This is basically, Net form of GDP, i.e. GDP – total value of wear and tear.

• NDP of an economy is always lower than its GDP, since their depreciation can never be reduced to zero. The concept of NDP and NNP are not used to compare different economies because the method of calculating depreciation varies from country to country.

E. National Income at Factor Cost (NIFC):

• It is the sum of all factors of income earned by the residents of a country (Indian) both from within the country as well as abroad.

• National Income at Factor Cost = NNP at Market Price – Indirect Taxes + Subsidies

• In India, and many developing countries across the world, National Income is measured at factor cost instead of market prices. Some of the reasons for the same are lack of uniformity in taxes, goods not being printed with their prices, etc.

• It is the sum of all factors of income earned by the residents of a country (Indian) both from within the country as well as abroad.

• National Income at Factor Cost = NNP at Market Price – Indirect Taxes + Subsidies

• In India, and many developing countries across the world, National Income is measured at factor cost instead of market prices. Some of the reasons for the same are lack of uniformity in taxes, goods not being printed with their prices, etc.

F. Transfer Payments

• A payment made by the government to individuals for whom there is no economic activity is produced in return. For example: Old Age Pensions, Scholarship etc.

• A payment made by the government to individuals for whom there is no economic activity is produced in return. For example: Old Age Pensions, Scholarship etc.

G. Personal Income

• It refers to all of the income collectively received by all of the individuals or households in a country.

• It includes compensation from a number of sources including salaries, wages and bonuses received from employment or self employment; dividends and distributions received from investments; rental receipt from real estate investments and profit sharing from businesses.

• In National Income Accounting, some income is attributed to individuals, which they do not actually receive. For Example: Undistributed Profits, Employees’ contribution for social security, corporate income taxes etc. which needs to be deducted from National Income to estimate the Personal Income.

• PI = NI + Transfer Payments – Corporate Retained Earnings, Income Taxes, Social Security Taxes.

• It refers to all of the income collectively received by all of the individuals or households in a country.

• It includes compensation from a number of sources including salaries, wages and bonuses received from employment or self employment; dividends and distributions received from investments; rental receipt from real estate investments and profit sharing from businesses.

• In National Income Accounting, some income is attributed to individuals, which they do not actually receive. For Example: Undistributed Profits, Employees’ contribution for social security, corporate income taxes etc. which needs to be deducted from National Income to estimate the Personal Income.

• PI = NI + Transfer Payments – Corporate Retained Earnings, Income Taxes, Social Security Taxes.

H. Disposable Personal Income

• It is the amount left with the individuals after paying Personal Taxes such as Income Tax, Property Tax, and Professional Tax etc. to spend as they like.

• DPI = PI – Taxes (Income Tax i.e. Personal Taxes)

• DPI results into Savings and Expenditure i.e. (Spend and Save). This concept is very useful for studying and understanding the consumption and saving behaviour of the individuals.

• It is the amount left with the individuals after paying Personal Taxes such as Income Tax, Property Tax, and Professional Tax etc. to spend as they like.

• DPI = PI – Taxes (Income Tax i.e. Personal Taxes)

• DPI results into Savings and Expenditure i.e. (Spend and Save). This concept is very useful for studying and understanding the consumption and saving behaviour of the individuals.

WHAT ARE THE FACTORS THAT AFFECT NATIONAL INCOME?

Several factors affect the national income of a country. Some of them have been listed below:

1. Factors of Production

Normally, the more efficient and richer the resources, higher will be the level of National Income or GNP

Several factors affect the national income of a country. Some of them have been listed below:

1. Factors of Production

Normally, the more efficient and richer the resources, higher will be the level of National Income or GNP

(a) Land

Resources like coal, iron and timber are essential for heavy industries so that they must be available and accessible. In other words, the geographical location of these natural resources affects the level of GNP.

Resources like coal, iron and timber are essential for heavy industries so that they must be available and accessible. In other words, the geographical location of these natural resources affects the level of GNP.

(b) Capital

Capital is generally determined by investment. Investment in turn depends on other factors like profitability, political stability etc.

Capital is generally determined by investment. Investment in turn depends on other factors like profitability, political stability etc.

(c) Labour

The quality or productivity of human resources is more important than quantity. Manpower planning and education affect the productivity and production capacity of an economy.

The quality or productivity of human resources is more important than quantity. Manpower planning and education affect the productivity and production capacity of an economy.

(d) Entrepreneur

(e) Technology

This factor is more important for Nations with fewer natural resources. The development in technology is affected by the level of invention and innovation in production.

This factor is more important for Nations with fewer natural resources. The development in technology is affected by the level of invention and innovation in production.

(f) Government

Government can help to provide a favourable business environment for investment. It provides law and order, regulations.

Government can help to provide a favourable business environment for investment. It provides law and order, regulations.

(g) Political Stability

A stable economy and political system helps in appropriate allocation of resources. Wars, strikes and social unrests will discourage investment and business activities.

A stable economy and political system helps in appropriate allocation of resources. Wars, strikes and social unrests will discourage investment and business activities.

Methods of National Income Calculation

There are three approaches and methods of measuring National Income:

There are three approaches and methods of measuring National Income:

A. Income Method

• By this National Income is calculated compiling income of factors of production viz., land, labour, capital and entrepreneur.

• National Income = Total Wage + Total Rent + Total Interest + Total Profit

• In Indian context, since 1993 as per the System of National Accounts (SNA), National Income is total of the following:

• GDP = Compensation of Employees + Consumption of Fixed Capital + (Other Taxes on Production – Subsidies of Production) + Gross Operating Surplus

• Compensation of employees: (Wage) salaries paid in cash and kind and other benefits provided to employees.

• Consumption of Fixed Capital: wear and tear of machinery which are replaced by new parts.

• Other Taxes on Production minus Subsidies: Net tax on production.

• There is a difference between tax on products and tax on production. Tax on products includes taxes like sales tax and excise duty. Tax on production is tax imposed irrespective of production like license fees and land tax.

• Gross Operating Surplus: balance of value added after deducting the above three components. It goes to pay rent of land and interest of capital.

• By this National Income is calculated compiling income of factors of production viz., land, labour, capital and entrepreneur.

• National Income = Total Wage + Total Rent + Total Interest + Total Profit

• In Indian context, since 1993 as per the System of National Accounts (SNA), National Income is total of the following:

• GDP = Compensation of Employees + Consumption of Fixed Capital + (Other Taxes on Production – Subsidies of Production) + Gross Operating Surplus

• Compensation of employees: (Wage) salaries paid in cash and kind and other benefits provided to employees.

• Consumption of Fixed Capital: wear and tear of machinery which are replaced by new parts.

• Other Taxes on Production minus Subsidies: Net tax on production.

• There is a difference between tax on products and tax on production. Tax on products includes taxes like sales tax and excise duty. Tax on production is tax imposed irrespective of production like license fees and land tax.

• Gross Operating Surplus: balance of value added after deducting the above three components. It goes to pay rent of land and interest of capital.

B. Product Method (or Value Added Method, Output Method)

• It is used by economists to calculate GDP at market prices, which are the total values of outputs produced at different stages of production.

• It is used by economists to calculate GDP at market prices, which are the total values of outputs produced at different stages of production.

Some of the goods and services included in production are:

• Goods and services actually sold in the market.

• Goods and services not sold but supplied free of cost. (No Charge/Complementary)

• Goods and services actually sold in the market.

• Goods and services not sold but supplied free of cost. (No Charge/Complementary)

Some of the goods and services not included in production are:

• Second hand items and purchase and sale of the same. Sale and purchase of second cars, for example, are not a part of GDP calculation as no new production takes place in the economy.

• Production due to unwarranted/ illegal activities.

• Non-economic goods or natural goods such as air and water.

• Transfer Payments such as scholarships, pensions etc. are excluded as there is income received, but no good or service is produced in return.

• Imputed rental for owner-occupied housing is also excluded.

• Here the Gross Value of final goods and services produced in a country in certain year is calculated.

• GDP is a concept of value added; it is the sum of gross value added of all resident producer units (institutional sectors, or industries) plus that part of taxes (total) less subsidies, on products which is not included in the valuation of output.

• Gross Value Added = Output of Final Goods and Services – Intermediate Consumption

• National Income = Gross Value Added + Indirect Taxes – Subsidies

• Second hand items and purchase and sale of the same. Sale and purchase of second cars, for example, are not a part of GDP calculation as no new production takes place in the economy.

• Production due to unwarranted/ illegal activities.

• Non-economic goods or natural goods such as air and water.

• Transfer Payments such as scholarships, pensions etc. are excluded as there is income received, but no good or service is produced in return.

• Imputed rental for owner-occupied housing is also excluded.

• Here the Gross Value of final goods and services produced in a country in certain year is calculated.

• GDP is a concept of value added; it is the sum of gross value added of all resident producer units (institutional sectors, or industries) plus that part of taxes (total) less subsidies, on products which is not included in the valuation of output.

• Gross Value Added = Output of Final Goods and Services – Intermediate Consumption

• National Income = Gross Value Added + Indirect Taxes – Subsidies

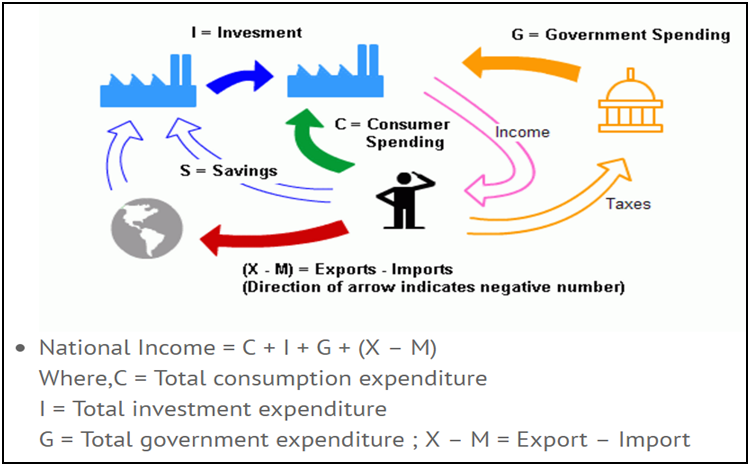

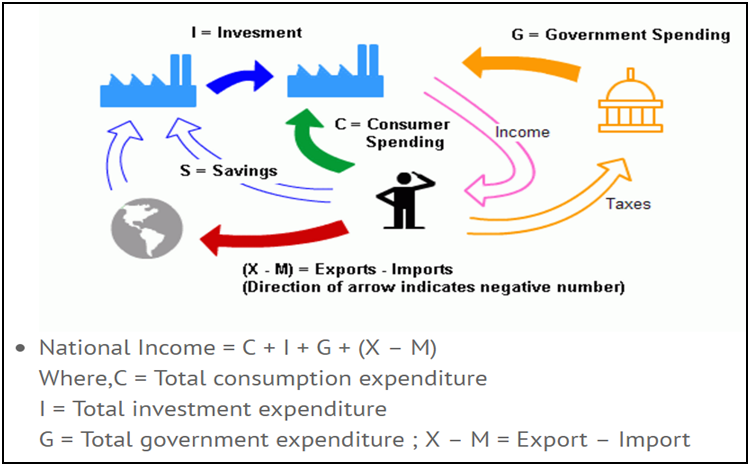

C. Expenditure Method

• It measures all spending on currently-produced final goods and services only in an economy.

• In an economy, there are three main agencies which buy goods and services: Households, Firms and the Government.

• It measures all spending on currently-produced final goods and services only in an economy.

• In an economy, there are three main agencies which buy goods and services: Households, Firms and the Government.

This final expenditure is made up of the sum of 4 expenditure items, namely;

• Consumption (C): Personal Consumption made by households, the payment of which is paid by households directly to the firms which produced the goods and services desired by the households.

• Consumption (C): Personal Consumption made by households, the payment of which is paid by households directly to the firms which produced the goods and services desired by the households.

• Investment Expenditure (I): Investment is an addition to capital stock of an economy in a given time period. This includes investments by firms as well as governments sectors.

• Government Expenditure (G): This category includes the value of goods and service purchased by Government. Government expenditure on pension schemes, scholarships, unemployment allowances etc. are not included in this as all of them come under transfer payments.

• Net Exports (X-IM): Expenditures on foreign made products (Imports) are expenditure that escapes the system, and must be subtracted from total expenditures. In turn, goods produced by domestic firms which are demanded by foreign economies involve expenditure by other economies on our production (Exports), and are included in total expenditure. The combination of the two gives us Net Exports.

• National Income = Consumption (C) + Investment Expenditure (I) + Government Expenditure (G) + Net Exports (X-IM)

• Calculating GDP (National Income) is extremely important as the performance of the economy is fixed by means of this method. The results would help the country to forecast the economic progress, determine the demand and supply, understand the buying power of the people, the per capita income, the position of the economy in the global arena. The Indian GDP is calculated by the expenditure method.

Economic Survey Chapter – 2

The Economic Vision for Precocious, Cleavaged India

The Economic Vision for Precocious, Cleavaged India (Economic Survey Chapter – 2)

Context

With a paradigm shift in Economic model in 1990s, by which India transitioned from protectionist inward oriented closed economy towards more free liberalized economy (by facilitating freer trade, easy foreign capital flow, rationalizing working of PSU and reinventing role of government as a facilitator). A vast and diverse country, which started poor, was courageous enough to adopt a democratic government and economic structure and in the course has achieved spectacular socio-economic development. However the still persisting ambivalence towards private sector, inefficient state machinery which fails in effective redistribution, must embrace the path of reform with a broader social shift in ideas and vision.

With a paradigm shift in Economic model in 1990s, by which India transitioned from protectionist inward oriented closed economy towards more free liberalized economy (by facilitating freer trade, easy foreign capital flow, rationalizing working of PSU and reinventing role of government as a facilitator). A vast and diverse country, which started poor, was courageous enough to adopt a democratic government and economic structure and in the course has achieved spectacular socio-economic development. However the still persisting ambivalence towards private sector, inefficient state machinery which fails in effective redistribution, must embrace the path of reform with a broader social shift in ideas and vision.

Technical Terms

A. Trade to GDP ratio: Export plus import expressed as share of GDP. It is a marker of economic liberty of an economy. The trade to GDP ratio of India significantly improved post 1990’s reform.

B. Retrospective tax: A tax levied for transactions in the past (which was either taxed at lower rate or was tax free owing to exemptions).e.g. Vodafone tax issue. A retrospective tax is considered to be regressive and anti market as it erodes government’s credibility and adds to policy uncertainty.

C. Twin Balance sheet problem: It refers to the poor economic state of Public sector banks at one hand (huge Non Performing Assets) and Corporate houses on other (due to low profitability and shortage of loan).In case of India both these problems are interdependent as a majority share of NPA with the banks are from the corporates and DISCOMS. This has created a vicious cycle whereby banks avoid lending corporates and corporates fail to repay their debt owing to lack of capital and profitability.

D. Competitive federalism: It refers to a tendency among states to compete and outperform each other in attracting more economic investment in their state e.g. newly formed state of Telangana and Andhra Pradesh rank in the top of the “Ease of doing business” list.

E. Exclusion Error: Deserving candidates do not receive benefits.

F. Inclusion error: Non deserving receive benefits.

G. Leakage: Benefits siphoned off by corruption and inefficiency.

H. Exit issue: The obstacles faced by firms, wanting to wrap up their business. Exit issue in India is one of the prominent reasons for its poor ranking in ease of doing business.

B. Retrospective tax: A tax levied for transactions in the past (which was either taxed at lower rate or was tax free owing to exemptions).e.g. Vodafone tax issue. A retrospective tax is considered to be regressive and anti market as it erodes government’s credibility and adds to policy uncertainty.

C. Twin Balance sheet problem: It refers to the poor economic state of Public sector banks at one hand (huge Non Performing Assets) and Corporate houses on other (due to low profitability and shortage of loan).In case of India both these problems are interdependent as a majority share of NPA with the banks are from the corporates and DISCOMS. This has created a vicious cycle whereby banks avoid lending corporates and corporates fail to repay their debt owing to lack of capital and profitability.

D. Competitive federalism: It refers to a tendency among states to compete and outperform each other in attracting more economic investment in their state e.g. newly formed state of Telangana and Andhra Pradesh rank in the top of the “Ease of doing business” list.

E. Exclusion Error: Deserving candidates do not receive benefits.

F. Inclusion error: Non deserving receive benefits.

G. Leakage: Benefits siphoned off by corruption and inefficiency.

H. Exit issue: The obstacles faced by firms, wanting to wrap up their business. Exit issue in India is one of the prominent reasons for its poor ranking in ease of doing business.

Gist of Economic Survey Chapter

Introduction

Economic vision animating Indian policy can be divided into two phases, first socialism and then ‘Washington consensus’ phase starting after 1991 reforms.

During socialism phase,

• The guiding principles were economic nationalism and protectionism.

• Public sector occupied the commanding heights and

• Government intruded into even the most micro-decisions of private firms: their investing, producing, and trading.

This framework was rejected after 199 but what replaced it is still not clear. At one level one thinks that India has replaced its erstwhile socialist vision with something resembling the “Washington Consensus”: open trade, open capital, and reliance on the private sector. Reforms along these lines have carried by all governments. In past few years reforms like:

• Institutionalized a commitment to low inflation in the new monetary policy framework agreement

• Focus on improving Ease of Doing Business

• Passage of GST Bill, Bankruptcy code

During socialism phase,

• The guiding principles were economic nationalism and protectionism.

• Public sector occupied the commanding heights and

• Government intruded into even the most micro-decisions of private firms: their investing, producing, and trading.

This framework was rejected after 199 but what replaced it is still not clear. At one level one thinks that India has replaced its erstwhile socialist vision with something resembling the “Washington Consensus”: open trade, open capital, and reliance on the private sector. Reforms along these lines have carried by all governments. In past few years reforms like:

• Institutionalized a commitment to low inflation in the new monetary policy framework agreement

• Focus on improving Ease of Doing Business

• Passage of GST Bill, Bankruptcy code

Economic Transformation in past 25 years

As a result of these steps remarkable economic transformation has been achieved in last 25 years. This transformation can be measured using four standard measures: openness to trade; openness to foreign capital; the extent to which public sector enterprises dominate commercial activities; and the share of government expenditure in overall spending.

A. Openness to trade (measured in Trade to GDP ratio):

• India’s ratio has been rising sharply, particularly over the decade to 2012, when it doubled to 53 per cent (India has Trade to GDP ratio of nearly 15% in 1991, 26% in 2002). As a result, India’s ratio now surpasses China.

• India also trades more and has better trade to GDP ratio as compared to similar geographically sized countries like US, Brazil and Russia. (Small countries trade more with outside world, whereas big countries trade less with outside world because of large internal market).

B. Openness to foreign capital

• Despite significant capital controls, India’s net inflows are, in fact, quite normal compared with other emerging economies. India’s FDI has risen sharply over time. In fact, in the most recent year, FDI is running at an annual rate of $75 billion, which is not far short of the amounts that China was receiving at the height of its growth boom in the mid-2000s.

C. Size of PSUs:

• Going against the popular perception, the share of PSUs in market has been coming down in wake of liberalization and entry of private players in sectors like telecom, civil aviation, financial services etc.

• These have all served to reduce the share of the public sector even if there has not been much exit of the PSU enterprises themselves. In India PSUs sale constitute 17% of national sale whereas they constitute around 27% in China.

D. Share of government expenditure in overall spending

• If we consider government expenditure against per capita of GDP, India spends as much as can be expected given its level of development.

In sum, the standard measures suggest that India is now a “normal” emerging market, pursuing the standard Asian development path and has progressed well and has grown at about 4.5 percent per capita for thirty seven years. This achievement has been remarkable because India has achieved this under a fully democratic system. The only other countries that have grown as rapidly and been democratic for a comparable proportion of the boom are Italy, Japan, Israel, and Ireland. Other countries that have grown faster for as long have tended to be oil exporters, East Asian countries,

As a result of these steps remarkable economic transformation has been achieved in last 25 years. This transformation can be measured using four standard measures: openness to trade; openness to foreign capital; the extent to which public sector enterprises dominate commercial activities; and the share of government expenditure in overall spending.

A. Openness to trade (measured in Trade to GDP ratio):

• India’s ratio has been rising sharply, particularly over the decade to 2012, when it doubled to 53 per cent (India has Trade to GDP ratio of nearly 15% in 1991, 26% in 2002). As a result, India’s ratio now surpasses China.

• India also trades more and has better trade to GDP ratio as compared to similar geographically sized countries like US, Brazil and Russia. (Small countries trade more with outside world, whereas big countries trade less with outside world because of large internal market).

B. Openness to foreign capital

• Despite significant capital controls, India’s net inflows are, in fact, quite normal compared with other emerging economies. India’s FDI has risen sharply over time. In fact, in the most recent year, FDI is running at an annual rate of $75 billion, which is not far short of the amounts that China was receiving at the height of its growth boom in the mid-2000s.

C. Size of PSUs:

• Going against the popular perception, the share of PSUs in market has been coming down in wake of liberalization and entry of private players in sectors like telecom, civil aviation, financial services etc.

• These have all served to reduce the share of the public sector even if there has not been much exit of the PSU enterprises themselves. In India PSUs sale constitute 17% of national sale whereas they constitute around 27% in China.

D. Share of government expenditure in overall spending

• If we consider government expenditure against per capita of GDP, India spends as much as can be expected given its level of development.

In sum, the standard measures suggest that India is now a “normal” emerging market, pursuing the standard Asian development path and has progressed well and has grown at about 4.5 percent per capita for thirty seven years. This achievement has been remarkable because India has achieved this under a fully democratic system. The only other countries that have grown as rapidly and been democratic for a comparable proportion of the boom are Italy, Japan, Israel, and Ireland. Other countries that have grown faster for as long have tended to be oil exporters, East Asian countries,

The Road To Be Traversed

Despite of these achievements there is a sense that India has not reached a desirable and optimal point, which can be explained as:

• There has been a hesitancy to embrace the private sector

• State capacity has remained weak ,

• And, redistribution has been simultaneously extensive and inefficient

A. Ambivalence about private sector and property rights

All states, all societies, have some ambivalence toward the private sector because of conflicting objectives of social concerns of state and profit maximization of private players. But the ambivalence in India seems greater than elsewhere as was found in World Value Survey. The symptoms of this ambivalence toward the private sector manifest in multiple ways, like:

• Difficulty to privatize public enterprises even for sectors which belong to private players, for example Air India in civil aviation, banking, fertilizer sector.

• In agriculture sector the compulsory requirement to sell in authorized markets through certain middleman under APMC (Agricultural Produce Market Committee) Act also reflects it.

• Moreover, policy reform in the sector has been interventionist reflected in restrictions on pricing.

• Ambivalence of past towards property rights, is visible in ‘retrospective taxation’ of present. This is true in a number of recent cases, including Vodafone and Monsanto.

• There is hesitation in taking decision for being seen as favoring the private sector, for example in debt write-offs by banks.

B. State capacity:

Indian economic model is characterized by the weakness of state capacity, especially in delivering essential services such as health and education. Indian state capacity has not increased as those of other emerging countries. The Indian state has low capacity, with high levels of corruption, clientism, rules and red tape.

Though Indian competitive federalism has focused on attracting investment and competitive populism, it has not focused much on issue of essential service delivery especially in health and education sector, except for few exception like PDS reform in Chhattisgarh, Kerosene free derive in Haryana and power sector reforms in Gujarat. This weak state capacity has created various problems like:

• It inhibits effective service delivery

• Constrains policy making in certain areas, as state do not want to be seen as favoring particular interests. It has further created problems like:

– Strict adherence to rules that may not necessarily be optimal public policy. For example auctioning cannot always be the optimal policy for selling all natural resources.

– Abundant precaution in bureaucratic decision making because of fear of four Cs, CBI, CVC, CAG and courts.

C. Inefficient distribution:

Indian state welfare spending suffers from considerable misallocation. This leads to: exclusion errors (the deserving poor not receiving benefits), inclusion errors (the non-poor receiving a large share of benefits) and leakages (with benefits being siphoned off due to corruption and inefficiency). Some plausible explanations for it are:

• India has followed a unique pathway to economic success, what might be called “Precocious, Cleavaged India” which explains these anomalies.

• Indian economic progress was achieved simultaneous to political progress. Whereas in other countries like developed economies, economic development preceded political development. Universal franchise and other political rights put extra demands on low economically developed Indian state, whereas such demands were not present for authoritarian states or states which benefited from industrialization of 19th century.

• Along with this India was a highly cleavage society, with more cleavages than any other society: language and scripts, religion, region, caste, gender, and class.

This along with shining example of USSR created a intellectual zeal for ‘socialism’ and natural distrust for private sector (especially because of failure of private sector under colonial rule in India and in other countries).Under these circumstances India adopted mixed economic model, which resulted into

• Strict controls over private sector.

• India adopting for redistribution early in the development process, when its state capacity was particularly weak.

• Low investment in human capital – for instance, public spending on health was an unusually low 0.22 per cent of the GDP in 1950-51 – because of low resources.

• Inefficient redistribution, using blunt and leaky instruments.

Though interventions began under compulsion, there is only partial explanation for failure to exit. Exit is difficult everywhere but it can be especially difficult in a poor, cleavaged democracy dominated by vested interests, weak institutions and an ideology that favors redistribution over investments

Normally states provide essential services (physical security, health, education, infrastructure, etc.) first before they take on their redistribution role, because unless the middle class in society perceives that it derives some benefits from the state, it will be unwilling to finance redistribution. Otherwise the middle class will seek to exit from the state, which is reflected in lower number of taxpayers relative to voting age in India. This exit will further shrink the state, erodes its legitimacy, further reduces resources and state will enter into a vicious cycle.

Despite of these achievements there is a sense that India has not reached a desirable and optimal point, which can be explained as:

• There has been a hesitancy to embrace the private sector

• State capacity has remained weak ,

• And, redistribution has been simultaneously extensive and inefficient

A. Ambivalence about private sector and property rights

All states, all societies, have some ambivalence toward the private sector because of conflicting objectives of social concerns of state and profit maximization of private players. But the ambivalence in India seems greater than elsewhere as was found in World Value Survey. The symptoms of this ambivalence toward the private sector manifest in multiple ways, like:

• Difficulty to privatize public enterprises even for sectors which belong to private players, for example Air India in civil aviation, banking, fertilizer sector.

• In agriculture sector the compulsory requirement to sell in authorized markets through certain middleman under APMC (Agricultural Produce Market Committee) Act also reflects it.

• Moreover, policy reform in the sector has been interventionist reflected in restrictions on pricing.

• Ambivalence of past towards property rights, is visible in ‘retrospective taxation’ of present. This is true in a number of recent cases, including Vodafone and Monsanto.

• There is hesitation in taking decision for being seen as favoring the private sector, for example in debt write-offs by banks.

B. State capacity:

Indian economic model is characterized by the weakness of state capacity, especially in delivering essential services such as health and education. Indian state capacity has not increased as those of other emerging countries. The Indian state has low capacity, with high levels of corruption, clientism, rules and red tape.

Though Indian competitive federalism has focused on attracting investment and competitive populism, it has not focused much on issue of essential service delivery especially in health and education sector, except for few exception like PDS reform in Chhattisgarh, Kerosene free derive in Haryana and power sector reforms in Gujarat. This weak state capacity has created various problems like:

• It inhibits effective service delivery

• Constrains policy making in certain areas, as state do not want to be seen as favoring particular interests. It has further created problems like:

– Strict adherence to rules that may not necessarily be optimal public policy. For example auctioning cannot always be the optimal policy for selling all natural resources.

– Abundant precaution in bureaucratic decision making because of fear of four Cs, CBI, CVC, CAG and courts.

C. Inefficient distribution:

Indian state welfare spending suffers from considerable misallocation. This leads to: exclusion errors (the deserving poor not receiving benefits), inclusion errors (the non-poor receiving a large share of benefits) and leakages (with benefits being siphoned off due to corruption and inefficiency). Some plausible explanations for it are:

• India has followed a unique pathway to economic success, what might be called “Precocious, Cleavaged India” which explains these anomalies.

• Indian economic progress was achieved simultaneous to political progress. Whereas in other countries like developed economies, economic development preceded political development. Universal franchise and other political rights put extra demands on low economically developed Indian state, whereas such demands were not present for authoritarian states or states which benefited from industrialization of 19th century.

• Along with this India was a highly cleavage society, with more cleavages than any other society: language and scripts, religion, region, caste, gender, and class.

This along with shining example of USSR created a intellectual zeal for ‘socialism’ and natural distrust for private sector (especially because of failure of private sector under colonial rule in India and in other countries).Under these circumstances India adopted mixed economic model, which resulted into

• Strict controls over private sector.

• India adopting for redistribution early in the development process, when its state capacity was particularly weak.

• Low investment in human capital – for instance, public spending on health was an unusually low 0.22 per cent of the GDP in 1950-51 – because of low resources.

• Inefficient redistribution, using blunt and leaky instruments.

Though interventions began under compulsion, there is only partial explanation for failure to exit. Exit is difficult everywhere but it can be especially difficult in a poor, cleavaged democracy dominated by vested interests, weak institutions and an ideology that favors redistribution over investments

Normally states provide essential services (physical security, health, education, infrastructure, etc.) first before they take on their redistribution role, because unless the middle class in society perceives that it derives some benefits from the state, it will be unwilling to finance redistribution. Otherwise the middle class will seek to exit from the state, which is reflected in lower number of taxpayers relative to voting age in India. This exit will further shrink the state, erodes its legitimacy, further reduces resources and state will enter into a vicious cycle.

Conclusion

India has come a long way in terms of economic performance and reforms. But there is still a journey ahead to achieve both dynamism and social justice. One tentative conclusion is that completing this journey will require a further evolution in the underlying economic vision across the political spectrum which should focus on improving state capacity, trusting private sector and improving redistribution delivery.

India has come a long way in terms of economic performance and reforms. But there is still a journey ahead to achieve both dynamism and social justice. One tentative conclusion is that completing this journey will require a further evolution in the underlying economic vision across the political spectrum which should focus on improving state capacity, trusting private sector and improving redistribution delivery.

National committee on Trade Facilitation

National committee on Trade Facilitation

The Union Cabinet has approved the Trade Facilitation Agreement (TFA) of WTO.

The Trade Facilitation Agreement contains provisions for expediting the movement, release and clearance of goods, including goods in transit. It also sets out measures for effective cooperation between customs and other appropriate authorities on trade facilitation and customs compliance issues. It further contains provisions for technical assistance and capacity building in this area.

In tune to this India will require “legal changes” and that includes inward and outward processing to facilitate re-import and re-export of goods for repair, reconditioning; and release of goods before payment of duty will have to be allowed on a guarantee/surety in all cases of imports where the duty is not determined prior to or upon arrival, or as rapidly as possible after arrival.

To facilitate both domestic coordination and implementation of the provisions of the Agreement, a National Committee on Trade Facilitation would be set up under the Joint Chair of Secretary, Department of Revenue and Secretary, Department of Commerce.

The committee has a three-tier structure with the main national committee as the pivot for monitoring the implementation of the TFA.

The composition of the NCTF is inclusive at the national committee level which will comprise of Secretaries of all key Departments involved in trade issues like Revenue, Commerce, Agriculture, Home, Shipping, Health etc. It will also have Chairman CBEC, Chairman Railway Board, and Director General Foreign Trade as Members. Major trade associations like CII, FICCI, and FIEO etc are also its Members. Joint Secretary, Customs, CBEC will be its Member Secretary. The total membership stands at 24 and the Committee can co-opt any representatives from the State Governments on relevant issues. The steering committee will be a core group having 15 members from various Ministries and trade bodies.

India Ranking Different Indexes 2016

India Ranking Different Indexes 2016

Other Important Reports

GST Council

GST Council

As per Article 279A (1) of the amended Constitution, the GST Council has to be constituted by the President within 60 days of the commencement of Article 279A.

As per Article 279A of the amended Constitution, the GST Council will be a joint forum of the Centre and the States. This Council shall consist of the following members namely:

a) Union Finance Minister… Chairperson

b) The Union Minister of State, in-charge of Revenue of finance… Member

c) The Minister In-charge of finance or taxation or any other Minister nominated by each State Government… Members.

b) The Union Minister of State, in-charge of Revenue of finance… Member

c) The Minister In-charge of finance or taxation or any other Minister nominated by each State Government… Members.

As per Article 279A (4), the Council will make recommendations to the Union and the States on important issues related to GST, like the goods and services that may be subjected or exempted from GST, model GST Laws, principles that govern Place of Supply, threshold limits, GST rates including the floor rates with bands, special rates for raising additional resources during natural calamities/disasters, special provisions for certain States, etc.

Central Government has inter alia, taken the following decisions for smooth functioning of GST Council –

a. Creation of the GST Council Secretariat, with its office at New Delhi;

b. Appointment of the Secretary (Revenue) as the Ex-officio Secretary to the GST Council;

c. Inclusion of the Chairperson, Central Board of Excise and Customs (CBEC), as a permanent invitee (non-voting) to all proceedings of the GST Council;

d. Create one post of Additional Secretary to the GST Council in the GST Council Secretariat (at the level of Additional Secretary to the Government of India), and four posts of Commissioner in the GST Council Secretariat (at the level of Joint Secretary to the Government of India).

a. Creation of the GST Council Secretariat, with its office at New Delhi;

b. Appointment of the Secretary (Revenue) as the Ex-officio Secretary to the GST Council;

c. Inclusion of the Chairperson, Central Board of Excise and Customs (CBEC), as a permanent invitee (non-voting) to all proceedings of the GST Council;

d. Create one post of Additional Secretary to the GST Council in the GST Council Secretariat (at the level of Additional Secretary to the Government of India), and four posts of Commissioner in the GST Council Secretariat (at the level of Joint Secretary to the Government of India).

The Cabinet has also decided to provide for adequate funds for meeting the recurring and non recurring expenses of the GST Council Secretariat, the entire cost for which shall be borne by the Central Government. The GST Council Secretariat shall be manned by officers taken on deputation from both the Central and State Governments.

While discharging the functions conferred by this article, the Goods and Services Tax Council shall be guided by the need for a harmonised structure of goods and services tax and for the development of a harmonised national market for goods and services. The Goods and Services Tax Council shall determine the procedure in the performance of its functions.

No comments:

Post a Comment