Money/Inflation

Money Inflation

Money

Money is “anything” that is generally acceptable as a means of exchange and which at the same time acts as a measure and store of value. “Anything” – implies a thing to be used as money which need not be necessarily composed of any precious metal. The only necessary condition is that, it should be universally accepted by people as a medium of exchange which is guaranteed by the Government of the country.

FUNCTION OF MONEY

Money performs five important functions

Money performs five important functions

1. Medium of exchange

• For transaction in any economy, money is used in the form or currency or checks as a medium of exchange. The use of money as a medium of exchange promotes economic efficiency by minimizing the time spent in exchanging goods and services (barter system).

• For transaction in any economy, money is used in the form or currency or checks as a medium of exchange. The use of money as a medium of exchange promotes economic efficiency by minimizing the time spent in exchanging goods and services (barter system).

2. Measure of value/Unit of Account

• Money is used to measure units in economy. We measure the value of goods and services in terms of money, just as we measure weight in terms of kilos or distance in terms of meters.

• Money is used to measure units in economy. We measure the value of goods and services in terms of money, just as we measure weight in terms of kilos or distance in terms of meters.

3. Store of value

• Money functions as a repository of purchasing power over time. This function of money is useful, because most of us do not want to spend our income immediately upon receiving it, but rather prefer to wait until we have the time or the desire to shop.

• Money functions as a repository of purchasing power over time. This function of money is useful, because most of us do not want to spend our income immediately upon receiving it, but rather prefer to wait until we have the time or the desire to shop.

4. Standard or Deferred Payment

• Money facilitates not only the current transactions of goods and services but also their credit transactions. It facilitates credit transactions when present goods are exchanged against future payments. In the modem world, the bulk of deferred payments are stipulated in money terms only.

• Money facilitates not only the current transactions of goods and services but also their credit transactions. It facilitates credit transactions when present goods are exchanged against future payments. In the modem world, the bulk of deferred payments are stipulated in money terms only.

5. Transfer of value

• It involves the transferring of value of any asset to another or to any institution or to any place by transferring money. This transfer can take place irrespective of places, time and circumstances. Transfer of purchasing power, which is necessary in commerce and other transaction, has become available because of money.

• It involves the transferring of value of any asset to another or to any institution or to any place by transferring money. This transfer can take place irrespective of places, time and circumstances. Transfer of purchasing power, which is necessary in commerce and other transaction, has become available because of money.

CLASSIFICATION OF MONEY

Actual Money – Money which actually circulates in the economy in terms of which all payments are made and general purchasing power is held as a medium of exchange. In Pakistan, notes and coins of all denominations are actual money.

Actual Money – Money which actually circulates in the economy in terms of which all payments are made and general purchasing power is held as a medium of exchange. In Pakistan, notes and coins of all denominations are actual money.

Money of Account – In terms of which prices are expressed and accounts are maintained. Normally, actual money and money of account are the same but sometimes they are different. For example: Paisa is a money of account in Pakistan but it is not actual money. Now a day, it is no more in circulation.

Metallic Money – It’s made of metal such as gold and silver. Coins of all denomination circulating in economy are examples of metallic money. Metallic money is classified into two categories:

• Full bodied money: If the face value of money is equal to its value as a commodity, it is called full bodied money. If a gold coin of face value Rs. 100/- contains gold worth of Rs. 100/- it will be called full bodied money or sometimes standard money

• Token Money: If the face value of money is more than its value as commodity or intrinsic value it is known as token money.

Paper Money – Money made of paper is called paper money. It includes different denomination. Paper money is further classified into following forms.

• Representative Paper Money: If paper is issued by keeping hundred percent gold reserve of full bodied coins or gold bullion, it will be called representative money.

• Convertible Paper Money: If paper money can be converted into gold coins or gold bullion on demand it is referred to as convertible money. This type of money is issued by keeping metallic reserve of equal amount behind it.

• Fiat or In-convertible Paper Money: which cannot be converted into full bodied coins or gold bullion on demand. It is usually issued without keeping metallic reserve behind it.

Legal Tender Money – Money which has a legal approval behind it and people are bound by law to accept it in all payments. Nobody can refuse to accept it. Legal Tender Money can be classified into:

• Limited Legal Tender: which can be given in payments only upto a certain limit. The payee can refuse to accept it beyond that limit. In many Asians countries 25 paisa coin and coins of low denominations are limited legal tender. These coins can be given as payments up to 50 rupees only.

• Unlimited Legal Tender: Unlimited legal tender means that money which can be given in payments up to any limit.

Optional Money – That form of money which is used as a medium of exchange but it has no legal force behind it. It includes credit instruments like cheques, bills or exchange and CDRs etc. which are generally acceptable in payments.

Hot Money- Money that moves regularly and quickly between financial markets so that investors could ensure they are getting the highest short-term interest rates available. Hot money continuously shifts from countries with low interest rates to those with higher interest rates affecting the exchange rate (if there is a high sum) and also has the potentiality to impact a country’s balance of payments.

Commodity Money – Its value is derived from the commodity out of which it is made. The commodity itself represents money, and the money is the commodity. For instance, commodities that have been used as a medium of exchange include gold, silver, copper, salt, peppercorns, rice, large stones etc.

Commercial Bank Money – These are the demand deposits which are claims against financial institutions which can be used for purchasing goods and services.

POSITION OF INDIAN RUPEE

The Indian Rupee is a mixture of the standard money and the token money. Like standard money, it is unlimited legal tender, and like the token money, its face value is greater than is intrinsic value. The Indian rupee is said to be a note printed on silver (now Nickel).

The Indian Rupee is a mixture of the standard money and the token money. Like standard money, it is unlimited legal tender, and like the token money, its face value is greater than is intrinsic value. The Indian rupee is said to be a note printed on silver (now Nickel).

MONEY SUPPLY IN INDIA

• It refers to total supply of money in circulation in a given country’s economy at a given time. Money supply is considered as an important instrument for controlling inflation by some of the economists.

• Economists analyze the money supply and develop policies revolving around it through controlling interest rates and increasing or decreasing the amount of money flowing in the economy.

• Money supply data is collected, recorded and published periodically by the RBI. These are also known as Reserve Money.

• It refers to total supply of money in circulation in a given country’s economy at a given time. Money supply is considered as an important instrument for controlling inflation by some of the economists.

• Economists analyze the money supply and develop policies revolving around it through controlling interest rates and increasing or decreasing the amount of money flowing in the economy.

• Money supply data is collected, recorded and published periodically by the RBI. These are also known as Reserve Money.

RESERVE MONEY

M0

• (M0) = Currency in circulation + Bankers’ deposits with the RBI + Other deposits with the RBI = Net RBI Credit to the Government + RBI credit to the commercial sector + RBI’s claims on banks + RBI’s net is foreign assets + Government’s currency liabilities to the public – RBI’s net non-monetary liabilities.

• In other words, it is the most liquid measure of the money supply. It only includes cash or assets that could quickly be converted into currency. This measure is known as narrow money because it is the smallest measure of the money supply.

M0

• (M0) = Currency in circulation + Bankers’ deposits with the RBI + Other deposits with the RBI = Net RBI Credit to the Government + RBI credit to the commercial sector + RBI’s claims on banks + RBI’s net is foreign assets + Government’s currency liabilities to the public – RBI’s net non-monetary liabilities.

• In other words, it is the most liquid measure of the money supply. It only includes cash or assets that could quickly be converted into currency. This measure is known as narrow money because it is the smallest measure of the money supply.

M1

• M1 (also called as the Narrow Money) = Currency with public (coins, currency notes etc.) + demand deposits of the public.

• In other words, Narrow money is a category of money supply that includes all physical money like coins and currency along with demand deposits and other liquid assets held by the central bank.

• M1 (also called as the Narrow Money) = Currency with public (coins, currency notes etc.) + demand deposits of the public.

• In other words, Narrow money is a category of money supply that includes all physical money like coins and currency along with demand deposits and other liquid assets held by the central bank.

M2

• M2 = M1 +Post office saving deposits.

M3

• M3 (also called as the Broad Money or Money aggregates) = M1 + Time deposits of public with the banks.

M4

• M4 = M3 + Total Post office deposits (includes fixed deposits with the post offices)

• M2 = M1 +Post office saving deposits.

M3

• M3 (also called as the Broad Money or Money aggregates) = M1 + Time deposits of public with the banks.

M4

• M4 = M3 + Total Post office deposits (includes fixed deposits with the post offices)

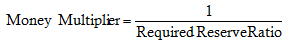

MONEY MULTIPLIER

Monetary multiplier represents the maximum extent to which the money supply is affected by any change in the amount of deposits. It equals ratio of increase or decrease in money supply to the corresponding increase and decrease in deposits.

• Required Reserve Ratio is the fraction of deposits which a bank is required to hold in hand. It can lend out an amount equals to excess reserves which equals 1 – required reserves.

• Higher the required reserve ratio, lesser the excess reserves, lesser the banks can lend as loans, and lower the money multiplier.

• Lower the required reserve ratio, higher the excess reserves, more the banks can lend, and higher is the money multiplier.

• In the above relationship it is assumed that there is no currency drainage, i.e. the borrowers keep 100% of the amount received in banks.

Monetary multiplier represents the maximum extent to which the money supply is affected by any change in the amount of deposits. It equals ratio of increase or decrease in money supply to the corresponding increase and decrease in deposits.

• Required Reserve Ratio is the fraction of deposits which a bank is required to hold in hand. It can lend out an amount equals to excess reserves which equals 1 – required reserves.

• Higher the required reserve ratio, lesser the excess reserves, lesser the banks can lend as loans, and lower the money multiplier.

• Lower the required reserve ratio, higher the excess reserves, more the banks can lend, and higher is the money multiplier.

• In the above relationship it is assumed that there is no currency drainage, i.e. the borrowers keep 100% of the amount received in banks.

LIQUIDITY

• It describes the degree to which an asset or security can be quickly bought or sold in the market without affecting the asset’s price.

• Liquidity might be our emergency savings account or the cash lying with us that we can access in case of any unforeseen happening or any financial setback. Liquidity also plays an important role as it allows us to seize opportunities.

• Market Liquidity refers to the extent to which a market, such as a country’s stock market or a city’s real estate market, allows assets to be bought and sold at stable prices. Cash is the most liquid asset, while real estate, fine art and collections are all relatively illiquid.

• It describes the degree to which an asset or security can be quickly bought or sold in the market without affecting the asset’s price.

• Liquidity might be our emergency savings account or the cash lying with us that we can access in case of any unforeseen happening or any financial setback. Liquidity also plays an important role as it allows us to seize opportunities.

• Market Liquidity refers to the extent to which a market, such as a country’s stock market or a city’s real estate market, allows assets to be bought and sold at stable prices. Cash is the most liquid asset, while real estate, fine art and collections are all relatively illiquid.

The importance of Liquidity

• An investor may need both liquid and illiquid assets. We need liquid assets to deal with any unexpected short-term crisis. But illiquid assets may offer greater chance for capital gains and higher yield.

• An investor may need both liquid and illiquid assets. We need liquid assets to deal with any unexpected short-term crisis. But illiquid assets may offer greater chance for capital gains and higher yield.

Liquidity ratio

• A liquidity ratio refers to the amount of liquid assets to overall assets. If a firm is highly liquid – it has a high proportion of assets that can easily be converted to cash to pay off any obligations.

• A liquidity ratio refers to the amount of liquid assets to overall assets. If a firm is highly liquid – it has a high proportion of assets that can easily be converted to cash to pay off any obligations.

Cash reserve ratio

• A bank may be required to keep a certain percentage of its assets in the form of liquid assets. It is the fraction of customer deposits held in cash reserves.

• Cash reserves are not profitable. If a bank lends deposits to other customers, it can charge interest and make more profit. But bank loans are highly illiquid because the bank cannot immediately ask for the loan back.

• A bank may be required to keep a certain percentage of its assets in the form of liquid assets. It is the fraction of customer deposits held in cash reserves.

• Cash reserves are not profitable. If a bank lends deposits to other customers, it can charge interest and make more profit. But bank loans are highly illiquid because the bank cannot immediately ask for the loan back.

FLOW OF MONEY

• A technical indicator calculated by multiplying a change in share price by the number of shares traded. Money flow is positive when a stock rises and negative when it declines. The indicator is used to investigate the momentum behind a price trend.

• A technical indicator calculated by multiplying a change in share price by the number of shares traded. Money flow is positive when a stock rises and negative when it declines. The indicator is used to investigate the momentum behind a price trend.

The importance of Money Flow:

• Money Flow is an important indicator of volume, a way to represent the inflow and outflow of investor’s money for security.

• Positive money flow means that investor interest is increasing, raising the demand for a security and, ostensibly, its price. Negative money flow shows the opposite: Investors are either capturing gains or losing faith in the value of the security or index, likely leading to declining prices.

• A common strategy stock traders implement with the money flow indicator is to enter or exit trades according to the overbought or oversold readings provided by the indicator.

• Money Flow is an important indicator of volume, a way to represent the inflow and outflow of investor’s money for security.

• Positive money flow means that investor interest is increasing, raising the demand for a security and, ostensibly, its price. Negative money flow shows the opposite: Investors are either capturing gains or losing faith in the value of the security or index, likely leading to declining prices.

• A common strategy stock traders implement with the money flow indicator is to enter or exit trades according to the overbought or oversold readings provided by the indicator.

DIGITIZATION OF MONEY

• The advent of the web and digitization has changed the way we work, shop, bunk, travel, educate, govern, manage our health and enjoy life by automatizing it.

• The technologies of digitization enable the conversion of traditional forms of information storage such as paper and photographs into the binary code (ones and zeros) of computer storage.

• A sub-set is the process of converting analog signals into digital signals. But much larger than the translation of any type of media into bits and bytes is the digital transformation of economic transactions and human interactions.

• With the passing of time the need has been felt in the banking sector and various other transactions due to increase in the volume and amount of banking transaction and rapidly increasing customers.

• To increase the cost of the product and generate more revenue it was realized that digitization and automation is need of the time especially for Banking Sector.

• Now, some of the banks are moving towards automated cash receipt/payment through recyclers, account opening through online with Aadhar validation, cheque sorting and processing for clearing and so many.

• The advent of the web and digitization has changed the way we work, shop, bunk, travel, educate, govern, manage our health and enjoy life by automatizing it.

• The technologies of digitization enable the conversion of traditional forms of information storage such as paper and photographs into the binary code (ones and zeros) of computer storage.

• A sub-set is the process of converting analog signals into digital signals. But much larger than the translation of any type of media into bits and bytes is the digital transformation of economic transactions and human interactions.

• With the passing of time the need has been felt in the banking sector and various other transactions due to increase in the volume and amount of banking transaction and rapidly increasing customers.

• To increase the cost of the product and generate more revenue it was realized that digitization and automation is need of the time especially for Banking Sector.

• Now, some of the banks are moving towards automated cash receipt/payment through recyclers, account opening through online with Aadhar validation, cheque sorting and processing for clearing and so many.

PLASTIC MONEY

Plastic money is a term that is used predominantly in reference to the hard plastic cards we use every day in place of actual bank notes. They can come in many different forms such as cash cards, credit cards, debit cards, pre-paid cash cards and store cards.

Plastic money is a term that is used predominantly in reference to the hard plastic cards we use every day in place of actual bank notes. They can come in many different forms such as cash cards, credit cards, debit cards, pre-paid cash cards and store cards.

5 different kinds of plastic money

A. Credit card

1. Cashless payment with a set spending limit

2. Payment takes place after the purchase

3. Great flexibility because of installment facility

4. Most well-known credit cards: American Express, MasterCard, Visa

A. Credit card

1. Cashless payment with a set spending limit

2. Payment takes place after the purchase

3. Great flexibility because of installment facility

4. Most well-known credit cards: American Express, MasterCard, Visa

B. Charge cards

1. Cashless payment without a set spending limit

2. Payment takes place after the purchase

3. No credit or installment facility

4. Most well-known charge cards: American Express, Diners Club

1. Cashless payment without a set spending limit

2. Payment takes place after the purchase

3. No credit or installment facility

4. Most well-known charge cards: American Express, Diners Club

C. Debit card

1. Card is directly linked to the cardholder’s bank account

2. Transaction is debited immediately from bank account

3. No credit or installment facility

4. Most well-known debit cards: Maestro, Postcard

1. Card is directly linked to the cardholder’s bank account

2. Transaction is debited immediately from bank account

3. No credit or installment facility

4. Most well-known debit cards: Maestro, Postcard

D. Customer card/store card (PLCC)

1. Card with payment and credit function

2. Can only be used at specific retailers

3. Well-known customer cards: myOne, Globus, Media Markt etc.

1. Card with payment and credit function

2. Can only be used at specific retailers

3. Well-known customer cards: myOne, Globus, Media Markt etc.

E. Prepaid card/gift card

1. Card is topped up with credit before use

2. No credit or installment facility

3. Open system (American Express, Visa, MasterCard) or closed system (can only be used at specific retailers)

The recent demonetization by the Government of India targeted towards killing three birds with one stone – black money, political opponents and subtly hard cash transaction.

1. Card is topped up with credit before use

2. No credit or installment facility

3. Open system (American Express, Visa, MasterCard) or closed system (can only be used at specific retailers)

The recent demonetization by the Government of India targeted towards killing three birds with one stone – black money, political opponents and subtly hard cash transaction.

LESS CASH ECONOMY: VISION 2018

• Reserve Bank of India (RBI) on June 2016, unveiled ‘Payment and Settlement System in India: Vision – 2018’ aimed at building best of class payment and settlement system for a ‘Less Cash’ India.

• Vision 2018 revolves around 5Cs: Coverage, Convenience, Confidence, Convergence and Cost.

• To achieve these, Vision 2018 will focus on four strategic initiatives such as responsive regulation, robust infrastructure, effective supervision and customer centricity.

• The regulatory framework, based on consultative approach, aims at achieving enhanced coverage of the payment systems coupled with convenience for end-users.

• A key objective would be to ensure a robust payments infrastructure in the country to increase accessibility, availability, interoperability and security.

• The oversight and supervisory framework would focus on strengthening the resilience of both large value and retail payment systems in the country.

• With increasing use of technology-based innovative payment products, the strategic initiatives under Vision-2018 are expected to reduce paper-based instruments significantly and lead to accelerated growth in mobile banking and other modes of electronic payments.

• To promote mobile phones as access channel to payment and banking services, the guidelines will be reviewed to address issues related to customer registration for mobile banking, safety and security of transactions, risk mitigation and customer grievance redressal measures.

• The White Label ATM Guidelines will accordingly be examined holistically and targets realigned to meet present conditions as the same has not resulted in the much needed growth in ATM infrastructure in the desired geographical segments of the country i.e. Rural and Semi-Urban areas.

• Reserve Bank of India (RBI) on June 2016, unveiled ‘Payment and Settlement System in India: Vision – 2018’ aimed at building best of class payment and settlement system for a ‘Less Cash’ India.

• Vision 2018 revolves around 5Cs: Coverage, Convenience, Confidence, Convergence and Cost.

• To achieve these, Vision 2018 will focus on four strategic initiatives such as responsive regulation, robust infrastructure, effective supervision and customer centricity.

• The regulatory framework, based on consultative approach, aims at achieving enhanced coverage of the payment systems coupled with convenience for end-users.

• A key objective would be to ensure a robust payments infrastructure in the country to increase accessibility, availability, interoperability and security.

• The oversight and supervisory framework would focus on strengthening the resilience of both large value and retail payment systems in the country.

• With increasing use of technology-based innovative payment products, the strategic initiatives under Vision-2018 are expected to reduce paper-based instruments significantly and lead to accelerated growth in mobile banking and other modes of electronic payments.

• To promote mobile phones as access channel to payment and banking services, the guidelines will be reviewed to address issues related to customer registration for mobile banking, safety and security of transactions, risk mitigation and customer grievance redressal measures.

• The White Label ATM Guidelines will accordingly be examined holistically and targets realigned to meet present conditions as the same has not resulted in the much needed growth in ATM infrastructure in the desired geographical segments of the country i.e. Rural and Semi-Urban areas.

Cashless Economy: From Barter System to Cash System and then Less Cash Economy

• A cashless economy is one in which all the transaction are done using cards or digital means. The circulation of physical currency is minimal.

• Money in liquid form (in hand cash) guaranteed by the Central Bank and backed by the Government of India is a promise made to citizen to complete the transactions by using various denominations.

• By drawing out liquidity from the market RBI promotes the use of plastic money in the form of cash cards, credit cards, debit cards, pre-paid cash cards and store cards etc.

• India uses too much cash for transactions. The ratio of cash to gross domestic product is one of the highest in the world – 12.42% in 2014 compared with 9.47% in China or 4% in Brazil.

• Less than 5% of all payments happen electronically in India which is very less.

• A cashless economy is one in which all the transaction are done using cards or digital means. The circulation of physical currency is minimal.

• Money in liquid form (in hand cash) guaranteed by the Central Bank and backed by the Government of India is a promise made to citizen to complete the transactions by using various denominations.

• By drawing out liquidity from the market RBI promotes the use of plastic money in the form of cash cards, credit cards, debit cards, pre-paid cash cards and store cards etc.

• India uses too much cash for transactions. The ratio of cash to gross domestic product is one of the highest in the world – 12.42% in 2014 compared with 9.47% in China or 4% in Brazil.

• Less than 5% of all payments happen electronically in India which is very less.

Steps taken by RBI and Government to discourage use of cash:

• Promotion of Mobile Wallet which will allow users to send/receive money, pay bills, recharge mobiles, book movie tickets, send physical and e-gifts both online and offline.

• No new license will be given to payment banks.

• India is liberalizing the FDI norms in order to promote E-commerce.

• Government has also launched Unified Payment Interface (UPI) in order to make electronic transfer much faster and simpler.

• Promotion of Mobile Wallet which will allow users to send/receive money, pay bills, recharge mobiles, book movie tickets, send physical and e-gifts both online and offline.

• No new license will be given to payment banks.

• India is liberalizing the FDI norms in order to promote E-commerce.

• Government has also launched Unified Payment Interface (UPI) in order to make electronic transfer much faster and simpler.

Economic Survey Chapter – 3

Demonetisation: To Deify or Demonize?

Demonetisation: To Deify or Demonize? (Economic Survey Chapter – 3)

Context

The unprecedented policy decision by the Government to Demonetize the economy of the higher denomination currencies (i.e. Rs. 500 and Rs. 1000), comprises of three broad aspects i.e.

o A money supply contraction (of only Cash)

o A tax on unaccounted private wealth(i.e. Black money)

o A tax on saving outside formal financial system.

With the objective of cracking down on Black money, counterfeit (fake currency), terror activity (fed by the first two) and progressive transition towards a cashless inclusive digital economy, the bold step of Demonetization has received a mixed bag of outcomes, though the full range of impacts can only be understood over one financial year (at least).Hence, the Government’s approach is (and should be) to take further policy actions to minimize short term costs and maximize long term benefits.

o A money supply contraction (of only Cash)

o A tax on unaccounted private wealth(i.e. Black money)

o A tax on saving outside formal financial system.

With the objective of cracking down on Black money, counterfeit (fake currency), terror activity (fed by the first two) and progressive transition towards a cashless inclusive digital economy, the bold step of Demonetization has received a mixed bag of outcomes, though the full range of impacts can only be understood over one financial year (at least).Hence, the Government’s approach is (and should be) to take further policy actions to minimize short term costs and maximize long term benefits.

Technical Terms

A. SIT (Special Investigation Team): A team of professional investigators appointed by the Supreme court to look into the issue of black money (source, destination, ways to bring back money stashed abroad and ways to stop generation of same)

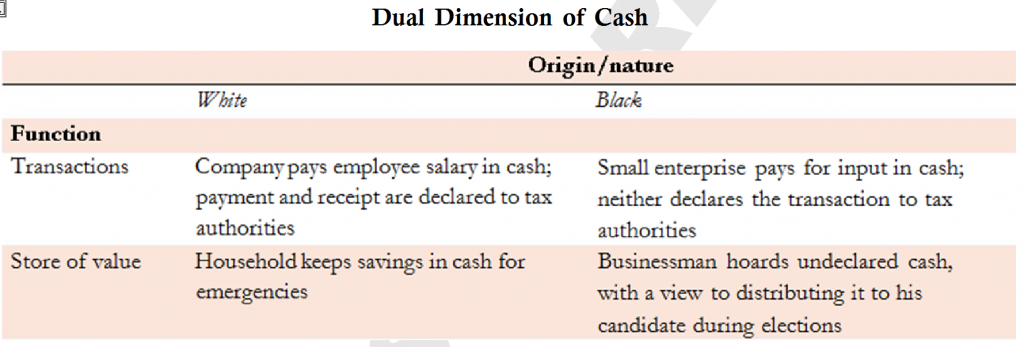

B. Money: It is the commonly accepted medium of exchange .It also acts as convenient unit of account (of all goods and services) and a store of value for individuals (i.e wealth can be stored in terms of money for future use).

C. Fiat Money: Currency notes and coins are called fiat money, which do not have intrinsic value (like gold or silver).These are also called legal tenders as they can not be refused by any citizen of the country for settlement of any kind of transaction.

D. Money Supply/Liquidity: The notes, coins, Demand Deposits(saving/current) are considered as money.

E. Black Money: Funds earned on the black market on which income and other taxes have not been paid or which is the proceeds of criminal activity such as bribery and corruption.

F. Soil rate: Rate at which notes are considered to be too damaged to use and are returned to the Central Bank. Generally the higher denomination notes have a lower soil rate than the low denomination notes.

G. Global Financial Crisis: It refers to a global scale financial crisis, which originated from the sub-prime mortgage market in USA (i.e. banks providing loans on mortgages, which has less commensurate value) and developed into a full grown banking crisis(fall of Lehman Brothers). The crisis was followed by global economic downturn and great recession, from which the world has still not recovered fully.

H. Indirect tax revenue: A tax which is collected from the ultimate consumer of a particular Good/Service. The tax burden lies on the final consumer and not the intermediary who transacts (e.g. sales tax, value added tax, excise duty).It is considered as a regressive tax , as it is charged at the same rate from both poor and rich(no equity).

I. Real Credit Growth: Increase in Amount of credit disbursed by the banks. Credit typically grows faster than GDP as the economy develops (more matured).

J. Nominal GDP: It refers to the Gross domestic product evaluated at current market price, whereas the real GDP evaluates GDP at prices of Base year (i.e a standard year)

K. GDP Deflator: It is a measure of the level of prices of all new, domestically produced, final goods and services in an economy. It is calculated by dividing Nominal GDP/Real GDP

L. Quantity theory of Money:

MV = PY, where [M refers to the money supply ,V is velocity, the rate at which money turns over, P is the price level ,Y is real GDP ]

• If the money supply is reduced, either the remaining stock of money will need to be used more intensively, or else nominal GDP will fall.

M. Informal Economy: The informal sector, informal economy, or grey economy is the part of an economy that is neither taxed, nor monitored by any form of government. Unlike the formal economy, activities of the informal economy are not included in the gross national product (GNP) and gross domestic product (GDP) of a country. e.g street vendors in Indi

N. Internal Convertibility: The ability of an economy to be able to convert cash into bank deposits and vice versa. The greater the convertibility , more is the confidence in formal banking system.

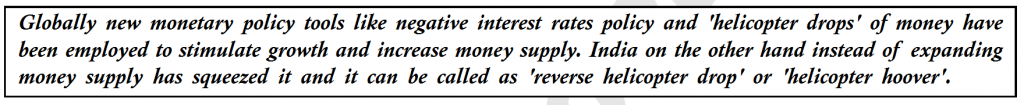

O. Negative interest rates policy: negative interest rate policy means financial institutions like banks will be penalised for keeping money. This will encourage them to lend it for economic activity.

P. Helicopter drop/helicopter money: The idea of a helicopter money drop has been mooted by Milton Friedman and Ben Bernanke, among others. It means giving everyone direct money transfers. In theory, people would see this as a permanent one-off expansion of the amount of money in circulation and would then start to spend more freely, increasing broader economic activity and pushing inflation back up to the central bank’s target.

B. Money: It is the commonly accepted medium of exchange .It also acts as convenient unit of account (of all goods and services) and a store of value for individuals (i.e wealth can be stored in terms of money for future use).

C. Fiat Money: Currency notes and coins are called fiat money, which do not have intrinsic value (like gold or silver).These are also called legal tenders as they can not be refused by any citizen of the country for settlement of any kind of transaction.

D. Money Supply/Liquidity: The notes, coins, Demand Deposits(saving/current) are considered as money.

E. Black Money: Funds earned on the black market on which income and other taxes have not been paid or which is the proceeds of criminal activity such as bribery and corruption.

F. Soil rate: Rate at which notes are considered to be too damaged to use and are returned to the Central Bank. Generally the higher denomination notes have a lower soil rate than the low denomination notes.

G. Global Financial Crisis: It refers to a global scale financial crisis, which originated from the sub-prime mortgage market in USA (i.e. banks providing loans on mortgages, which has less commensurate value) and developed into a full grown banking crisis(fall of Lehman Brothers). The crisis was followed by global economic downturn and great recession, from which the world has still not recovered fully.

H. Indirect tax revenue: A tax which is collected from the ultimate consumer of a particular Good/Service. The tax burden lies on the final consumer and not the intermediary who transacts (e.g. sales tax, value added tax, excise duty).It is considered as a regressive tax , as it is charged at the same rate from both poor and rich(no equity).

I. Real Credit Growth: Increase in Amount of credit disbursed by the banks. Credit typically grows faster than GDP as the economy develops (more matured).

J. Nominal GDP: It refers to the Gross domestic product evaluated at current market price, whereas the real GDP evaluates GDP at prices of Base year (i.e a standard year)

K. GDP Deflator: It is a measure of the level of prices of all new, domestically produced, final goods and services in an economy. It is calculated by dividing Nominal GDP/Real GDP

L. Quantity theory of Money:

MV = PY, where [M refers to the money supply ,V is velocity, the rate at which money turns over, P is the price level ,Y is real GDP ]

• If the money supply is reduced, either the remaining stock of money will need to be used more intensively, or else nominal GDP will fall.

M. Informal Economy: The informal sector, informal economy, or grey economy is the part of an economy that is neither taxed, nor monitored by any form of government. Unlike the formal economy, activities of the informal economy are not included in the gross national product (GNP) and gross domestic product (GDP) of a country. e.g street vendors in Indi

N. Internal Convertibility: The ability of an economy to be able to convert cash into bank deposits and vice versa. The greater the convertibility , more is the confidence in formal banking system.

O. Negative interest rates policy: negative interest rate policy means financial institutions like banks will be penalised for keeping money. This will encourage them to lend it for economic activity.

P. Helicopter drop/helicopter money: The idea of a helicopter money drop has been mooted by Milton Friedman and Ben Bernanke, among others. It means giving everyone direct money transfers. In theory, people would see this as a permanent one-off expansion of the amount of money in circulation and would then start to spend more freely, increasing broader economic activity and pushing inflation back up to the central bank’s target.

Gist of Economic Survey Chapter

On 8th November demonetization was announced with the aim of the action was fourfold: to curb corruption; counterfeiting; the use of high denomination notes for terrorist activities; and especially the accumulation of “black money”, generated by income that has not been declared to the tax authorities.

It followed a series of earlier efforts to curb such illicit activities, including:

• The creation of the Special Investigative Team (SIT) in the 2014 budget;

• The Black Money and Imposition of Tax Act 2015;

• Benami Transactions Act 2016;

• The information exchange agreement with Switzerland;

• Changes in the tax treaties with Mauritius, Cyprus and Singapore; and

• The Income Disclosure Scheme.

Demonetisation was aimed at signalling and emphasizing the government’s determination to penalize illicit activities and the associated wealth. India’s demonetization was unprecedented in international economic history because:

• It was highly secretive and sudden

• It was carried out in normal economic and political condition exemplified by macro-economic stability and fastest GDP growth rate. All other sudden demonetisations have occurred in the context of hyperinflation, wars, political upheavals, or other extreme circumstances.

In India there were two previous instances of demonetisation, in 1946 and 1978, the latter not having any significant effect on cash, but the recent action had large, albeit temporary, currency consequences.

• The creation of the Special Investigative Team (SIT) in the 2014 budget;

• The Black Money and Imposition of Tax Act 2015;

• Benami Transactions Act 2016;

• The information exchange agreement with Switzerland;

• Changes in the tax treaties with Mauritius, Cyprus and Singapore; and

• The Income Disclosure Scheme.

Demonetisation was aimed at signalling and emphasizing the government’s determination to penalize illicit activities and the associated wealth. India’s demonetization was unprecedented in international economic history because:

• It was highly secretive and sudden

• It was carried out in normal economic and political condition exemplified by macro-economic stability and fastest GDP growth rate. All other sudden demonetisations have occurred in the context of hyperinflation, wars, political upheavals, or other extreme circumstances.

In India there were two previous instances of demonetisation, in 1946 and 1978, the latter not having any significant effect on cash, but the recent action had large, albeit temporary, currency consequences.

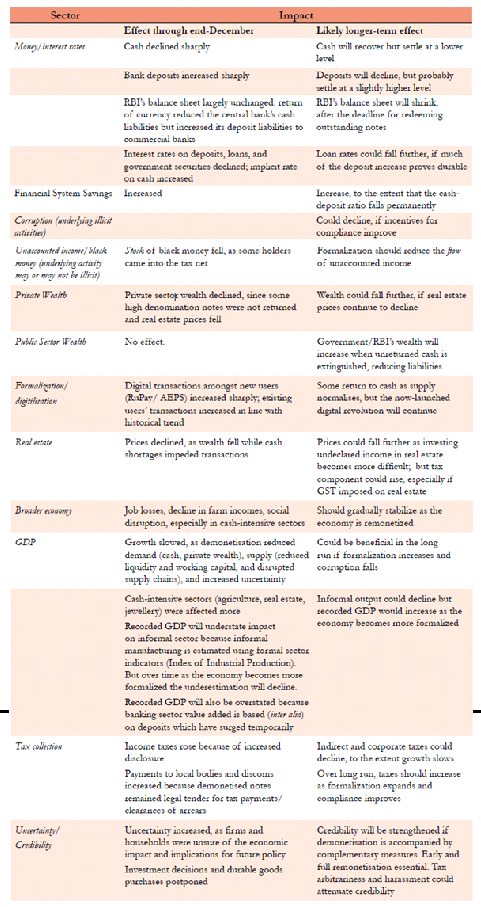

Demonetization’s Economic Impact in the Short and Medium Run

Calculating impact of demonetization will be a tedious task and require that certain important facts must be kept in mind.Certain facts which are relevant for understanding the rational of demonetization are:

• Currency to GDP ratio was increasing in India and was around 12% in 2014-15. The ratio of high demonization notes was even higher.

• India’s economy is relatively cash-dependent, even taking account of the fact that it is a relatively poor country (cash component of economy decreases with development).

• It may suggest that some of the cash holding was not used for legitimate transactions, but perhaps for other activities such as corruption.

• ‘Soil rates’ of high denomination notes (11% for 1000, 22% for 500 and 33% for smaller denomination notes) are lower as compared to lower denomination notes and similar high denomination notes in US. It indicate that all high denomination notes are not used for transactions but for storing money, especially black money of about Rs. 3 lakh cr or 2% of GDP.

Based on this assumption demonization would have long term benefit of reducing corruption.

In this assumption few things which must be kept in mind are:

• According to Transparency International data cash in circulation in India is relatively high for its level of corruption. This means that either level of corruption is much worse or cash is being used for legitimate purpose.

• Level of high denomination notes: In India’s case, the denomination/ income ratio has fallen sharply over the past quarter century because incomes have been growing rapidly and India stands midway in low income group countries on this count. This also shows that higher denomination notes have been increasingly used for transactions over time.

Calculating impact of demonetization will be a tedious task and require that certain important facts must be kept in mind.Certain facts which are relevant for understanding the rational of demonetization are:

• Currency to GDP ratio was increasing in India and was around 12% in 2014-15. The ratio of high demonization notes was even higher.

• India’s economy is relatively cash-dependent, even taking account of the fact that it is a relatively poor country (cash component of economy decreases with development).

• It may suggest that some of the cash holding was not used for legitimate transactions, but perhaps for other activities such as corruption.

• ‘Soil rates’ of high denomination notes (11% for 1000, 22% for 500 and 33% for smaller denomination notes) are lower as compared to lower denomination notes and similar high denomination notes in US. It indicate that all high denomination notes are not used for transactions but for storing money, especially black money of about Rs. 3 lakh cr or 2% of GDP.

Based on this assumption demonization would have long term benefit of reducing corruption.

In this assumption few things which must be kept in mind are:

• According to Transparency International data cash in circulation in India is relatively high for its level of corruption. This means that either level of corruption is much worse or cash is being used for legitimate purpose.

• Level of high denomination notes: In India’s case, the denomination/ income ratio has fallen sharply over the past quarter century because incomes have been growing rapidly and India stands midway in low income group countries on this count. This also shows that higher denomination notes have been increasingly used for transactions over time.

How to Look at Demonetization

Demonetisation should be seen as comprising the following:

• A money supply contraction but only of one type of “money”—cash;

• A tax on unaccounted private wealth maintained in the form of cash – black money; and

• A tax on savings outside the formal financial system.

Demonetisation should be seen as comprising the following:

• A money supply contraction but only of one type of “money”—cash;

• A tax on unaccounted private wealth maintained in the form of cash – black money; and

• A tax on savings outside the formal financial system.

Benefits of Demonetization

A. Tax on black money

Demonetization offered three options for black money holders:

• Declare their income, deposit it and pay tax rate with penalty

• Continue to hide and suffer 100% tax rate

• Launder their money

Anecdotal evidence says that there was money laundering through various methods like:

• Retime the accrual of money and then depositing in account

• Paying intermediaries to convert black money into white (as commission, payment for standing in queue, depositing in others account)

Despite these demonetization provided following benefits

• In all these cases, black money holders still suffered a substantial loss, in taxes or “conversion fees”.

• Laundering run the risk of punitive taxes and prosecution, in addition to the fees or taxes already paid because of continuous surveillance and data mining by government on spooky deposits.

• The December 30, 2016 Ordinance has declared the unreturned notes as no longerconstituting legal tender and this will extinguish RBI liability and increase its net worth.

In this sense, demonetisation has affected a transfer of wealth from holders of illicit black money to the public sector, which can then be redeployed in various productive ways – to retire government debt, recapitalize banks, or even redistribute back to the private sector.

B. Tax compliance

• Demonetization has shown state’s resolve to crack down on black money

• Social condemnation: Since this action has commanded support amongst the population, demonetisation shows that black money will no longer be tolerated by the wider public.

These two effects if combined with other incentive measures can result into behavioural change among people and greater tax compliance.

• Demonetisation could also aid tax administration in another way, by shifting transactions out of the cash economy and into the formal payments system.

• As a result, the tax-GDP ratio, as well as the size of the formal economy, could be permanently higher.

• It will channel more savings into financial system. It will help banks in providing more loans at lower rates.

• In the longer-term, if demonetisation is successful, it will reduce the equilibrium cash-GDP and cash-deposits ratio in the economy. This will increase financial savings which could have a positive impact on long run growth.

A. Tax on black money

Demonetization offered three options for black money holders:

• Declare their income, deposit it and pay tax rate with penalty

• Continue to hide and suffer 100% tax rate

• Launder their money

Anecdotal evidence says that there was money laundering through various methods like:

• Retime the accrual of money and then depositing in account

• Paying intermediaries to convert black money into white (as commission, payment for standing in queue, depositing in others account)

Despite these demonetization provided following benefits

• In all these cases, black money holders still suffered a substantial loss, in taxes or “conversion fees”.

• Laundering run the risk of punitive taxes and prosecution, in addition to the fees or taxes already paid because of continuous surveillance and data mining by government on spooky deposits.

• The December 30, 2016 Ordinance has declared the unreturned notes as no longerconstituting legal tender and this will extinguish RBI liability and increase its net worth.

In this sense, demonetisation has affected a transfer of wealth from holders of illicit black money to the public sector, which can then be redeployed in various productive ways – to retire government debt, recapitalize banks, or even redistribute back to the private sector.

B. Tax compliance

• Demonetization has shown state’s resolve to crack down on black money

• Social condemnation: Since this action has commanded support amongst the population, demonetisation shows that black money will no longer be tolerated by the wider public.

These two effects if combined with other incentive measures can result into behavioural change among people and greater tax compliance.

• Demonetisation could also aid tax administration in another way, by shifting transactions out of the cash economy and into the formal payments system.

• As a result, the tax-GDP ratio, as well as the size of the formal economy, could be permanently higher.

• It will channel more savings into financial system. It will help banks in providing more loans at lower rates.

• In the longer-term, if demonetisation is successful, it will reduce the equilibrium cash-GDP and cash-deposits ratio in the economy. This will increase financial savings which could have a positive impact on long run growth.

Early Evidence of Potential Long Term Benefits

Though it will take several years to see the impact of demonetization on illicit transactions, on black money, and on financial savings, there are some signs pointing to change.

A. Impact on Digitization

One intermediate objective of demonetisation is to create a less-cash or cash-lite economy, as this is a key to channelling more saving through the formal financial system and improving tax compliance.

Watal Committee has recently estimated that cash accounts for about 78 percent of all consumer payments.And there are many reasons for this situation. Cash has many advantages:

• It is convenient, accepted everywhere, and

• Its use is costless for ordinary people, though not of course for society at large.

• Cash transactions are also anonymous, helping to preserve privacy, which is a virtue as long as the transactions are not illicit or designed to evade taxation.

In contrast, digital transactions face significant impediments.

• They require special equipment, cell phones for customers and Point-Of-Sale (POS) machines for merchants, which will only work if there is internet connectivity.

• They are also costly to users, since e-payment firms need to recoup their costs by imposing charges on customers, merchants, or both.

At the same time, these disadvantages are counterbalanced by two cardinal virtues.

• Digital transactions help bring people into the modern “wired” era.

• And they bring people into the formal economy, thereby increasing financial saving, reducing tax evasion, and levelling the playing field between tax-compliant and tax-evading firms (and individuals).

In the wake of the demonetisation, the government has taken a number of steps to facilitate and incentivize the move to a digital economy. These include:

• Launch of the BHIM (Bharat Interface for Money) app for smart-phones based on the new Unified Payments Interface (UPI) which has created inter-operability of digital transactions.

• Launch of BHIM USSD 2.0, a product that allows the 350 million feature phone users to take advantage of the UPI.

• Launch of Aadhar Merchant Pay, aimed at the 350 million who do not have phones. This enables anyone with just an Aadhar number and a bank account to make a merchant payment using his biometric identification.

• Reductions in fees (Merchant Discount Rate) paid on digital transactions and transactions that use the UPI.

• There have also been relaxations of limits on the use of payment wallets.

• Tax benefits have also been provided for to incentivizedigital transactions.

• Encouraging the adoption of POS devices beyond the current 1.5 million, through tariff reductions.

As a result of all these number of digital transactions has increased considerably. Data from the National Payments Corporation of India (NPCI) show that RuPay-based electronic transactions increased by about Rs. 13,000 crore in case of POS transactions and about Rs. 2,000 crore in e-commerce, an increase of over 300-400 percent.Same has been the case with debit card, credit card and AEPS (Aadhar-Enabled Payments System) transactions.

The success of digitalization will depend considerably on

• The inter-operability of the payments system. The Unified Payments Interface (UPI) created by the NPCI is the technology platform that will be the basis for ensuring interoperability. But to ensure this, individual banks should facilitate not thwart inter-operability.

• As digital payments increase the security features of these e-payment systems will need to inspire trust, to ensure this trend continues.

B. Impact on Real estate sector

• Demonetization can have profound impact on real estate prices as black money was used evade taxes on property sale and have resulted into inflated prices. According to Knight Frank and Survey calculations real estate prices in eight major cities has started declining post demonetization.

• Reduction in real estate prices is desirable as it will lead to affordable housing for the middle class, and facilitate labour mobility across India currently impeded by high and unaffordable rents.

Though it will take several years to see the impact of demonetization on illicit transactions, on black money, and on financial savings, there are some signs pointing to change.

A. Impact on Digitization

One intermediate objective of demonetisation is to create a less-cash or cash-lite economy, as this is a key to channelling more saving through the formal financial system and improving tax compliance.

Watal Committee has recently estimated that cash accounts for about 78 percent of all consumer payments.And there are many reasons for this situation. Cash has many advantages:

• It is convenient, accepted everywhere, and

• Its use is costless for ordinary people, though not of course for society at large.

• Cash transactions are also anonymous, helping to preserve privacy, which is a virtue as long as the transactions are not illicit or designed to evade taxation.

In contrast, digital transactions face significant impediments.

• They require special equipment, cell phones for customers and Point-Of-Sale (POS) machines for merchants, which will only work if there is internet connectivity.

• They are also costly to users, since e-payment firms need to recoup their costs by imposing charges on customers, merchants, or both.

At the same time, these disadvantages are counterbalanced by two cardinal virtues.

• Digital transactions help bring people into the modern “wired” era.

• And they bring people into the formal economy, thereby increasing financial saving, reducing tax evasion, and levelling the playing field between tax-compliant and tax-evading firms (and individuals).

In the wake of the demonetisation, the government has taken a number of steps to facilitate and incentivize the move to a digital economy. These include:

• Launch of the BHIM (Bharat Interface for Money) app for smart-phones based on the new Unified Payments Interface (UPI) which has created inter-operability of digital transactions.

• Launch of BHIM USSD 2.0, a product that allows the 350 million feature phone users to take advantage of the UPI.

• Launch of Aadhar Merchant Pay, aimed at the 350 million who do not have phones. This enables anyone with just an Aadhar number and a bank account to make a merchant payment using his biometric identification.

• Reductions in fees (Merchant Discount Rate) paid on digital transactions and transactions that use the UPI.

• There have also been relaxations of limits on the use of payment wallets.

• Tax benefits have also been provided for to incentivizedigital transactions.

• Encouraging the adoption of POS devices beyond the current 1.5 million, through tariff reductions.

As a result of all these number of digital transactions has increased considerably. Data from the National Payments Corporation of India (NPCI) show that RuPay-based electronic transactions increased by about Rs. 13,000 crore in case of POS transactions and about Rs. 2,000 crore in e-commerce, an increase of over 300-400 percent.Same has been the case with debit card, credit card and AEPS (Aadhar-Enabled Payments System) transactions.

The success of digitalization will depend considerably on

• The inter-operability of the payments system. The Unified Payments Interface (UPI) created by the NPCI is the technology platform that will be the basis for ensuring interoperability. But to ensure this, individual banks should facilitate not thwart inter-operability.

• As digital payments increase the security features of these e-payment systems will need to inspire trust, to ensure this trend continues.

B. Impact on Real estate sector

• Demonetization can have profound impact on real estate prices as black money was used evade taxes on property sale and have resulted into inflated prices. According to Knight Frank and Survey calculations real estate prices in eight major cities has started declining post demonetization.

• Reduction in real estate prices is desirable as it will lead to affordable housing for the middle class, and facilitate labour mobility across India currently impeded by high and unaffordable rents.

Short Term Impacts

A. Impact on cash/money

• The true extent of the cash reduction was much smaller than commonly perceived, and the true peak of the monetary – as opposed to the psychological – shock occurred in December (35% shortfall), rather than November (25% shortfall).

• The shortfall is now narrowing rapidly. At end-December 2016, effective currency was only about 65 percent of estimated demand, but this is likely to rise to about 86 percent of transactions demand by end-February.

B. Impact on GDP

Demonetisation is potentially:

• An aggregate demand shock, because it reduces the supply of money and affects private wealth (especially of those holding unaccounted money and owning real estate);

• An aggregate supply shock to the extent that cash is a necessary input for economic activity (for example, if agricultural producers require cash to pay labour);

• An uncertainty shock because economic agents face imponderables related to the impact and duration of the liquidity shock as well as further policy responses.

To analyze the impact of demonetization on GDP in a macro-assessment on five broad indicators are focused:

• Agricultural (rabi) sowing;

• Indirect tax revenue, as a broad gauge of production and sales;

• Sales generally, as a measure of discretionary consumer spending, and two-wheelers in particular as it is the best available indicator of rural and demand of the less affluent;

• Real estate prices; and

• Real credit growth

The high frequency indicators present a mixed picture.

• Agricultural sowing, passenger car sales, and overall excise taxes bear little imprint of demonetisation;

• And sales of twowheelers show a marked decline after demonetisation;

• Credit numbers were already looking weak before demonetisation, and those pre-existing trends were further reinforced after November 8.

A. Impact on cash/money

• The true extent of the cash reduction was much smaller than commonly perceived, and the true peak of the monetary – as opposed to the psychological – shock occurred in December (35% shortfall), rather than November (25% shortfall).

• The shortfall is now narrowing rapidly. At end-December 2016, effective currency was only about 65 percent of estimated demand, but this is likely to rise to about 86 percent of transactions demand by end-February.

B. Impact on GDP

Demonetisation is potentially:

• An aggregate demand shock, because it reduces the supply of money and affects private wealth (especially of those holding unaccounted money and owning real estate);

• An aggregate supply shock to the extent that cash is a necessary input for economic activity (for example, if agricultural producers require cash to pay labour);

• An uncertainty shock because economic agents face imponderables related to the impact and duration of the liquidity shock as well as further policy responses.

To analyze the impact of demonetization on GDP in a macro-assessment on five broad indicators are focused:

• Agricultural (rabi) sowing;

• Indirect tax revenue, as a broad gauge of production and sales;

• Sales generally, as a measure of discretionary consumer spending, and two-wheelers in particular as it is the best available indicator of rural and demand of the less affluent;

• Real estate prices; and

• Real credit growth

The high frequency indicators present a mixed picture.

• Agricultural sowing, passenger car sales, and overall excise taxes bear little imprint of demonetisation;

• And sales of twowheelers show a marked decline after demonetisation;

• Credit numbers were already looking weak before demonetisation, and those pre-existing trends were further reinforced after November 8.

Effect on Economic Activity (Informal economy and formal economy)

• Informal economy has been effected by cash crunch

• Formal economy would have minimal direct impact but indirect impact, as workers who had been laid-off will buy fewer products like FMCG products, two wheelers.

• Conversely, some participants in the informal economy have shifted into the formal payments systems (such as kirana shops installing POS terminals).

• Also, in the cash intensive economy, the liquidity shortage has led at least transiently to a greater recourse to informal credit (such as kirana shops allowing regular customers to pay at a later date).

• It is also to be noted that recorded part of the economy will underestimate the impact of demonetization because of most of informal economy is unrecorded or data from formal sector is used to estimate for it.

• Informal economy has been effected by cash crunch

• Formal economy would have minimal direct impact but indirect impact, as workers who had been laid-off will buy fewer products like FMCG products, two wheelers.

• Conversely, some participants in the informal economy have shifted into the formal payments systems (such as kirana shops installing POS terminals).

• Also, in the cash intensive economy, the liquidity shortage has led at least transiently to a greater recourse to informal credit (such as kirana shops allowing regular customers to pay at a later date).

• It is also to be noted that recorded part of the economy will underestimate the impact of demonetization because of most of informal economy is unrecorded or data from formal sector is used to estimate for it.

Supply Side Effects

What are the possible supply side shocks?

• It is likely, for example, that uncertainty caused consumers to postpone purchases and firms to put off investments in the third quarter.

• Similarly, there was clearly a wealth shock in the initial months, as cash assets were turned into the banks (from where they were difficult to withdraw),

• Demonetisation could also affect supplies of certain agricultural products, especially milk (where procurement has been low), sugar (where cane availability and drought in the Southern states will restrict production), and potatoes and onions (where sowings have been low).

But as the economy is remonetised, restrictions are lifted and conditions normalise, the uncertainty and cash crunch should dissipate and spending might well rebound toward the end of the fiscal year.

However vigilance is needed against agriculture products price shooting up.

Based on all these factors it would be reasonable to conclude that economic activity has been affected adversely, but temporarily, by demonetisation in between ¼ and ½ percentage points relative to the baseline of about 7 percent and will be around 63/4 and 71/2. Over the medium run, the implementation of GST, follow-up to demonetization and other structural reform measures should take the trend rate of growth of the economy to the 8-10 percent range that India needs.

All these relatively benign outcome would materialise, however, if and only if remonetisation is effected expeditiously (it has been estimated that around 90 percent of transactions demand can be met before the end of current financial year), and decisive policy actions taken to clear away the uncertainty and dispel fears of an overzealous tax administration. Only then could the effects of demonetisation prove non-permanent in nature.

What are the possible supply side shocks?

• It is likely, for example, that uncertainty caused consumers to postpone purchases and firms to put off investments in the third quarter.

• Similarly, there was clearly a wealth shock in the initial months, as cash assets were turned into the banks (from where they were difficult to withdraw),

• Demonetisation could also affect supplies of certain agricultural products, especially milk (where procurement has been low), sugar (where cane availability and drought in the Southern states will restrict production), and potatoes and onions (where sowings have been low).

But as the economy is remonetised, restrictions are lifted and conditions normalise, the uncertainty and cash crunch should dissipate and spending might well rebound toward the end of the fiscal year.

However vigilance is needed against agriculture products price shooting up.

Based on all these factors it would be reasonable to conclude that economic activity has been affected adversely, but temporarily, by demonetisation in between ¼ and ½ percentage points relative to the baseline of about 7 percent and will be around 63/4 and 71/2. Over the medium run, the implementation of GST, follow-up to demonetization and other structural reform measures should take the trend rate of growth of the economy to the 8-10 percent range that India needs.

All these relatively benign outcome would materialise, however, if and only if remonetisation is effected expeditiously (it has been estimated that around 90 percent of transactions demand can be met before the end of current financial year), and decisive policy actions taken to clear away the uncertainty and dispel fears of an overzealous tax administration. Only then could the effects of demonetisation prove non-permanent in nature.

Redistribution to the Government

Demonetisation will also redistribute resources.

The most important redistributive effect is that it will shift resources from the private sector to the government. The impact on the overall economy will then depend on how the government responds.

Demonetisation will affect the fiscal accounts in the following ways.

• Wealth gain: The RBI/government may receive some gains from the unreturned cash

• Income taxes could go up as black money was deposited in bank accounts

• There are also reports of increases in tax payments at state government levels and accelerated payments to discoms.

Against this are three negative effects:

• Costs of printing new notes over and above normal replacement.

• The costs of sterilizing the surge in liquidity into the banking system via issuance of Market Stabilization Scheme bonds.

• If nominal GDP growth declines, corporate and indirect tax revenues of the centre could decline but so far there is no clear evidence.

Demonetisation will also redistribute resources.

The most important redistributive effect is that it will shift resources from the private sector to the government. The impact on the overall economy will then depend on how the government responds.

Demonetisation will affect the fiscal accounts in the following ways.

• Wealth gain: The RBI/government may receive some gains from the unreturned cash

• Income taxes could go up as black money was deposited in bank accounts

• There are also reports of increases in tax payments at state government levels and accelerated payments to discoms.

Against this are three negative effects:

• Costs of printing new notes over and above normal replacement.

• The costs of sterilizing the surge in liquidity into the banking system via issuance of Market Stabilization Scheme bonds.

• If nominal GDP growth declines, corporate and indirect tax revenues of the centre could decline but so far there is no clear evidence.

Markers of success

Though the benefits of demonetization will become visible in long term, but there are markers which will indicate future success. These are:

• Changes in the use of digital payment methods across the three categories of digital access identified earlier, namely, smart phone users, regular phone users and the phoneless, respectively.

• The cash-GDP ratio, which should decline as more saving, is channeled through the formal financial system and black money falls.

• The most important marker of success will be taxes. The number of new income tax payers as well as the magnitude of reported and taxable income should go up over time.

To the extent that demonetisation has also raised the costs of non-compliance with indirect taxes, we should also expect to see an increase in registration under the service and excise taxes and under the states’ VATs. These should drift up steadily in the future.

Though the benefits of demonetization will become visible in long term, but there are markers which will indicate future success. These are:

• Changes in the use of digital payment methods across the three categories of digital access identified earlier, namely, smart phone users, regular phone users and the phoneless, respectively.

• The cash-GDP ratio, which should decline as more saving, is channeled through the formal financial system and black money falls.

• The most important marker of success will be taxes. The number of new income tax payers as well as the magnitude of reported and taxable income should go up over time.

To the extent that demonetisation has also raised the costs of non-compliance with indirect taxes, we should also expect to see an increase in registration under the service and excise taxes and under the states’ VATs. These should drift up steadily in the future.

Maximizing long-term benefits, minimizing short-term costs

Moving forward, the emphasis must be on maximizing demonetization’s benefits while minimizing its costs. Certain steps which should be taken to achieve this are:

• The most important effort must be to replenish the cash shortage as quickly as possible.

• The government windfall arising from unreturned notes should be deployed toward capital-type expenditures rather than current ones.

• Since the windfall will be one-off its use should be one-off and not lead to entitlements that create permanently higher expenditures.

• In the medium term, the impetus provided to digitalization must continue.

• The transition to digitalization must be gradual; take full account of the digitally deprived; respect rather than dictate choice; and be inclusive rather than controlled.

• To increase trust in digital payments, cyber security systems must be strengthened considerably.

• One key need is to ensure inter-operability of the payment system, which will be at the heart of increasing digitalization going forward, building upon the newly created UPI.

• Measures to complement demonetization with other non-punitive, incentive-compatible measures that reduce the incentives for tax evasion should be taken.

Demonetization was a powerful stick which now needs carrots as complements. A five-pronged strategy could be adopted:

• A GST with broad coverage to include activities that are sources of black money creation—land and other immovable property—should be implemented;

• Individual income tax rates and real estate stamp duties could be reduced;

• The income tax net could be widened gradually and, consistent with constitutional arrangements, could progressively encompass all high incomes;

• The timetable for reducing the corporate tax rate could be accelerated; and

• Tax administration could be improved to reduce discretion and improve accountability.

• There must be a shift to greater use of data, smarter evidence-based scrutiny and audit, greater reliance on on-line assessments with correspondingly less interaction between tax payers and tax officials, greater coordination between different tax authorities

• Big Data and the digital age, and the promise they offer, should also be embraced by the tax administration.

Moving forward, the emphasis must be on maximizing demonetization’s benefits while minimizing its costs. Certain steps which should be taken to achieve this are:

• The most important effort must be to replenish the cash shortage as quickly as possible.

• The government windfall arising from unreturned notes should be deployed toward capital-type expenditures rather than current ones.

• Since the windfall will be one-off its use should be one-off and not lead to entitlements that create permanently higher expenditures.

• In the medium term, the impetus provided to digitalization must continue.

• The transition to digitalization must be gradual; take full account of the digitally deprived; respect rather than dictate choice; and be inclusive rather than controlled.

• To increase trust in digital payments, cyber security systems must be strengthened considerably.

• One key need is to ensure inter-operability of the payment system, which will be at the heart of increasing digitalization going forward, building upon the newly created UPI.

• Measures to complement demonetization with other non-punitive, incentive-compatible measures that reduce the incentives for tax evasion should be taken.

Demonetization was a powerful stick which now needs carrots as complements. A five-pronged strategy could be adopted:

• A GST with broad coverage to include activities that are sources of black money creation—land and other immovable property—should be implemented;

• Individual income tax rates and real estate stamp duties could be reduced;

• The income tax net could be widened gradually and, consistent with constitutional arrangements, could progressively encompass all high incomes;

• The timetable for reducing the corporate tax rate could be accelerated; and

• Tax administration could be improved to reduce discretion and improve accountability.

• There must be a shift to greater use of data, smarter evidence-based scrutiny and audit, greater reliance on on-line assessments with correspondingly less interaction between tax payers and tax officials, greater coordination between different tax authorities

• Big Data and the digital age, and the promise they offer, should also be embraced by the tax administration.

Conclusion

As it is unwise to predict the range of impact of Demonitaization beforehand(many macro economic data are not available and there is a gestation period for economic policies to show impact, which are dependent on many other complex variables), the endeavor should be to minimize the short term costs and increase long term benefits by -faster and prompt demonetization- facilitating internal convertibility -creating capital assets out of the extra revenue-facilitating and incentivizing digitization-reforming tax administration to incentivize and encourage genuine tax payers, while at the same time strengthening cyber security to generate trust among people.

As it is unwise to predict the range of impact of Demonitaization beforehand(many macro economic data are not available and there is a gestation period for economic policies to show impact, which are dependent on many other complex variables), the endeavor should be to minimize the short term costs and increase long term benefits by -faster and prompt demonetization- facilitating internal convertibility -creating capital assets out of the extra revenue-facilitating and incentivizing digitization-reforming tax administration to incentivize and encourage genuine tax payers, while at the same time strengthening cyber security to generate trust among people.

Impact of Demonetisation

Supplementary Reading

A. Experience of demonetization around world

1) Ghana 1982 –

• Measures: Demonetisation of 50 cedi notes in 1982; no exchange facility for long; freeze on bank deposits

• Rationale: Excess liquidity and inflation

• Effect: Loss of confidence in the banking system

2) Brazil 1990

• Measures: Collor Plan: monetary contraction by freezing all deposits above certain limit .Deposits upto a ceiling denominated in the old currency (cruzado novo) were converted to the new currency (cruzeiro) at parity.

• Rationale: To fight hyperinflation

• Effect: Contraction of output; price moderation only very gradual due to uncontrolled re- injection of liquidity

3) Australia (1988,2015)